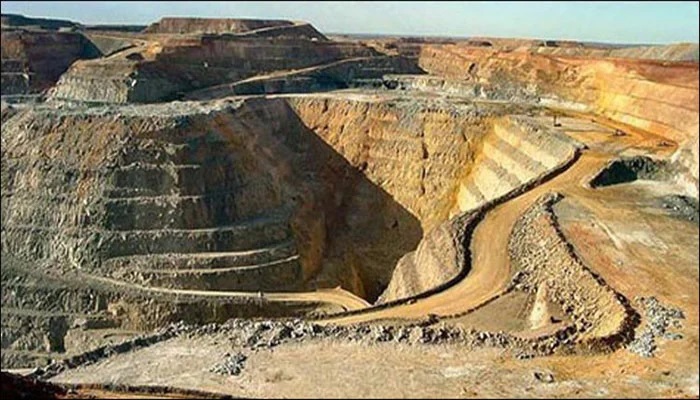

Barrick Gold Corp. and the governments of Pakistan and Balochistan have reached an agreement on a framework that provides for the reconstitution of the Reko Diq project in the country’s Balochistan province. The project, which was suspended in 2011 due to a dispute over the legality of its licensing process, hosts one of the world’s largest undeveloped open-pit copper-gold porphyry deposits.

Barrick Gold Corp. and the governments of Pakistan and Balochistan have reached an agreement on a framework that provides for the reconstitution of the Reko Diq project in the country’s Balochistan province. The project, which was suspended in 2011 due to a dispute over the legality of its licensing process, hosts one of the world’s largest undeveloped open-pit copper-gold porphyry deposits.

The project will be held 50% by Barrick and 50% by Pakistan stakeholders, comprising a 10% free-carried, non-contributing share held by Balochistan, an additional 15% held by a special purpose company owned by the government of Balochistan and 25% owned by other federal state-owned enterprises. A separate agreement provides for Barrick’s partner Antofagasta PLC to be replaced in the project by the Pakistani parties.

Barrick will be the operator of the project, which will be granted a mining lease, exploration license, surface rights and a mineral agreement stabilizing the fiscal regime applicable to the project for a specified period. The process to finalize and approve definitive agreements, including the stabilization of the fiscal regime pursuant to the mineral agreement, will be fully transparent and involve the federal and provincial governments, as well as the Supreme Court of Pakistan. If the definitive agreements are executed and the conditions to closing are satisfied, the project will be reconstituted including the resolution of the damages originally awarded by the International Centre for the Settlement of Investment Disputes and disputed in the International Chamber of Commerce.

“This is a unique opportunity for substantial foreign investment in the Balochistan province and will bring enormous direct and indirect benefits not only to this region but also to Pakistan for decades to come,” Barrick President and CEO Mark Bristow said. “In addition to local employment and skills development, local procurement, infrastructure upgrades and improved medical and education systems, Reko Diq could also be the springboard for further exploration and other mineral discoveries along the highly prospective Tethyan Metallogenic Belt.”

On closing, Barrick will start a full update of the project’s 2010 feasibility and 2011 expansion prefeasibility studies, which envisaged a conventional truck-and-shovel open-pit operation with comminution and flotation processing facilities producing a high-quality copper-gold concentrate. Bristow said that if all went according to plan, Reko Diq could be in production within five to six years.

Antofagasta has decided not to participate in the reconstituted project as the company’s growth strategy is focused on the production of copper and by-products in the Americas (particularly Chile, Peru, the USA and Canada) and the company said the Reko Diq project does not support this strategy.

The parties have agreed to work together over the course of this year to finalize and approve definitive agreements. The project will be reconstituted under Tethyan Copper Co. Pty Ltd. (TCC), a joint venture held equally by the company and Barrick, and TCC’s International Centre for the settlement of investment disputes award will be resolved. Also, a consortium comprising various Pakistani state-owned enterprises will acquire shares in TCC’s subsidiary which will hold the project for consideration of approximately US$900 million; and proceeds will be distributed to Antofagasta in return for its exit from the TCC holding structure.

If the conditions to closing are satisfied during 2022, Antofagasta expects to receive those proceeds during 2023.