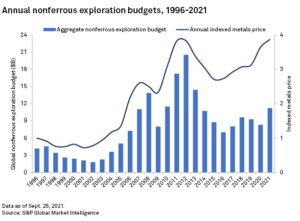

Annual nonferrous exploration budget increases from $8.3 billion in 2020 to $11.2 billion. (Source: S&P Global Market Intelligence)

The newly released 2021 global exploration budget from S&P Global Market Intelligence’s Corporate Exploration Strategies series shows that the mining exploration sector has emerged from the downturn caused by the COVID-19 pandemic. The aggregate annual global nonferrous exploration budget has increased by 35% year over year to $11.2 billion from $8.3 billion in 2020.

“A faster-than-expected recovery in market conditions and easing of lockdowns allowed explorers to reactivate programs by mid-2020, which caused some programs to carry over into 2021,” said Kevin Murphy, principal analyst with the metals and mining research team at S&P Global Market Intelligence. “Along with higher metals prices and increased financing activities, this has led to a strong budget recovery in 2021.

“As we move into the last quarter this year, metal prices and financings remain robust, and the risk of further pandemic-related shutdowns has declined. As a result, we expect the aggregate exploration budget to increase between 5% and 15% year over year for 2022.”

Gold and base metals dominate the exploration focus. While the gold price has varied over recent months, its August average of $1,784 per ounce (oz) was 14% higher than its January 2020 average of $1,560/oz. Base metals have had even more impressive gains, with copper’s August average of $4.25 per pound up 55% from January 2020.

Canada soars while Africa underperforms. While allocations to all regions have increased in 2021, Canada has attracted a particularly large share of the global budget with an increase of $800.5 million year over year to $2.1 billion, hitting its record high since 2012. Africa underperformed with allocations up just 12% to $1.1 billion, returning the region to its 2019 level.

Junior budgets surge but majors still drive exploration. The junior sector has increased their planned allocations by 62% year over year to a total of $4.1 billion. Despite this increase, the majors continue to account for half of the global exploration budget at a total of $5.6 billion.

Early-stage exploration budget hits all-time low. In 2020, grassroots share of allocations hit an all-time low of 24% while mine site hit an all-time high of 41% as the pandemic made large-scale programs more difficult. While grassroots share recovered modestly this year due to increased activity in Australia and Canada, its global budget share is the second lowest on record at 26%.