Agnico Eagle Mines Ltd. (AEM) and Kirkland Lake Gold Ltd. have received approval from Australia’s Foreign Investment Review Board (FIRB) regarding the proposed merger of equals between the companies. This approval is the final key regulatory approval needed to close the merger. The closing date is expected to occur on or about February 8.

Agnico Eagle Mines Ltd. (AEM) and Kirkland Lake Gold Ltd. have received approval from Australia’s Foreign Investment Review Board (FIRB) regarding the proposed merger of equals between the companies. This approval is the final key regulatory approval needed to close the merger. The closing date is expected to occur on or about February 8.

In September, AEM entered into an all-stock agreement to acquire Kirkland Lake Gold Ltd. in a “merger of equals,” which would retain the AEM name and be headquartered at AEM’s existing head office. KLG shareholders will receive 0.7935 of an AEM common share for each KLG share. The consideration implies a combined market capitalization of approximately $24 billion. Upon closing, existing AEM and KLG shareholders will own approximately 54% and 46% of the combined company, respectively.

The acquisition would increase AEM’s gold production from 1.7 million ounces per year (oz/y) to 3.4 million oz/y, making it the No. 3 gold producer behind Newmont and Barrick Gold. Upon closing, AEM is expected to have $2.3 billion of available liquidity, a mineral reserve base of 48 million ounces of gold, (969 million metric tons (mt) at 1.53 g/mt), and an extensive pipeline of development and exploration projects.

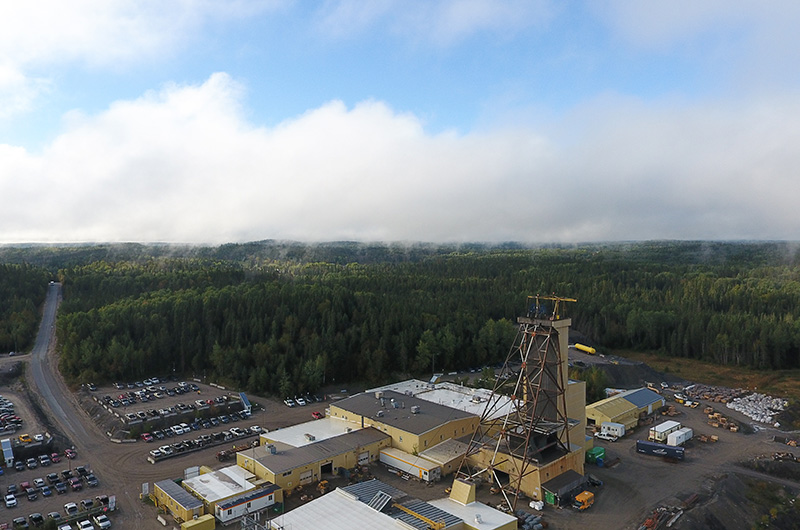

Agnico Eagle is a senior Canadian gold mining company, producing precious metals from operations in Canada, Finland and Mexico. It has a pipeline of high-quality exploration and development projects in these countries as well as in the United States and Colombia. Kirkland Lake Gold is a low-cost senior gold producer operating in Canada and Australia. The production profile of Kirkland Lake Gold is anchored by three high-quality operations, including the Macassa Mine and Detour Lake Mine, both located in Northern Ontario, and the Fosterville Mine located in the state of Victoria, Australia.