PotashCorp and Agrium Merger Will Create Dominant Crop Nutrient Supplier

Potash Corp. of Saskatchewan (PotashCorp) and Agrium Inc. have agreed to combine in an all-stock merger of equals that if completed will create the world’s largest integrated crop nutrient company and Canada’s third-largest natural resources company. A new parent company, yet to be named, will be formed to own both companies. PotashCorp shareholders will own approximately 52% and Agrium shareholders 48% of the new company.

The companies expect the transaction to close in mid-2017, subject to the satisfaction of customary closing conditions, including receipt of regulatory approvals, Canadian court approval, and approval by the shareholders of both companies.

PotashCorp is headquartered in Saskatoon, Saskatchewan, and is the world’s largest producer of potash and one of the largest producers of nitrogen and phosphate. The company has five potash mines in Saskatchewan and one in New Brunswick, which account for about 20% of world potash production capacity.

Agrium is headquartered in Calgary, Alberta. The company produces nitrogen, potash, and phosphate fertilizers and has a retail distribution network of more than 1,400 facilities and more than 3,800 crop consultants, who provide advice and products that help customers increase yields and returns on hundreds of different crops. The company owns and operates one potash mine in Saskatchewan.

The combined company will have close to 20,000 employees and a pro forma enterprise value of about $36 billion. On a 2015 pro forma basis, the combined company would have had net revenue of approximately $20.6 billion.

The companies anticipate that the merger will generate up to $500 million in annual operating synergies, with approximately $250 million of these synergies to be realized by the end of the first year after closing and the full run-rate achieved by the end of the second year.

PotashCorp President and CEO Jochen Tilk said, “Our merger creates a new premier Canadian-headquartered company that reflects our shared commitment to creating value and unlocking growth potential for shareholders. The integrated platform established through our combination will greatly benefit customers and suppliers, and support even greater career development opportunities for employees.”

Upon closing of the transaction, Tilk will serve as executive chairman and current Agrium President and CEO Chuck Magro will serve as CEO of the new company. The company will have its registered head office in Saskatoon and corporate offices in both Saskatoon and Calgary.

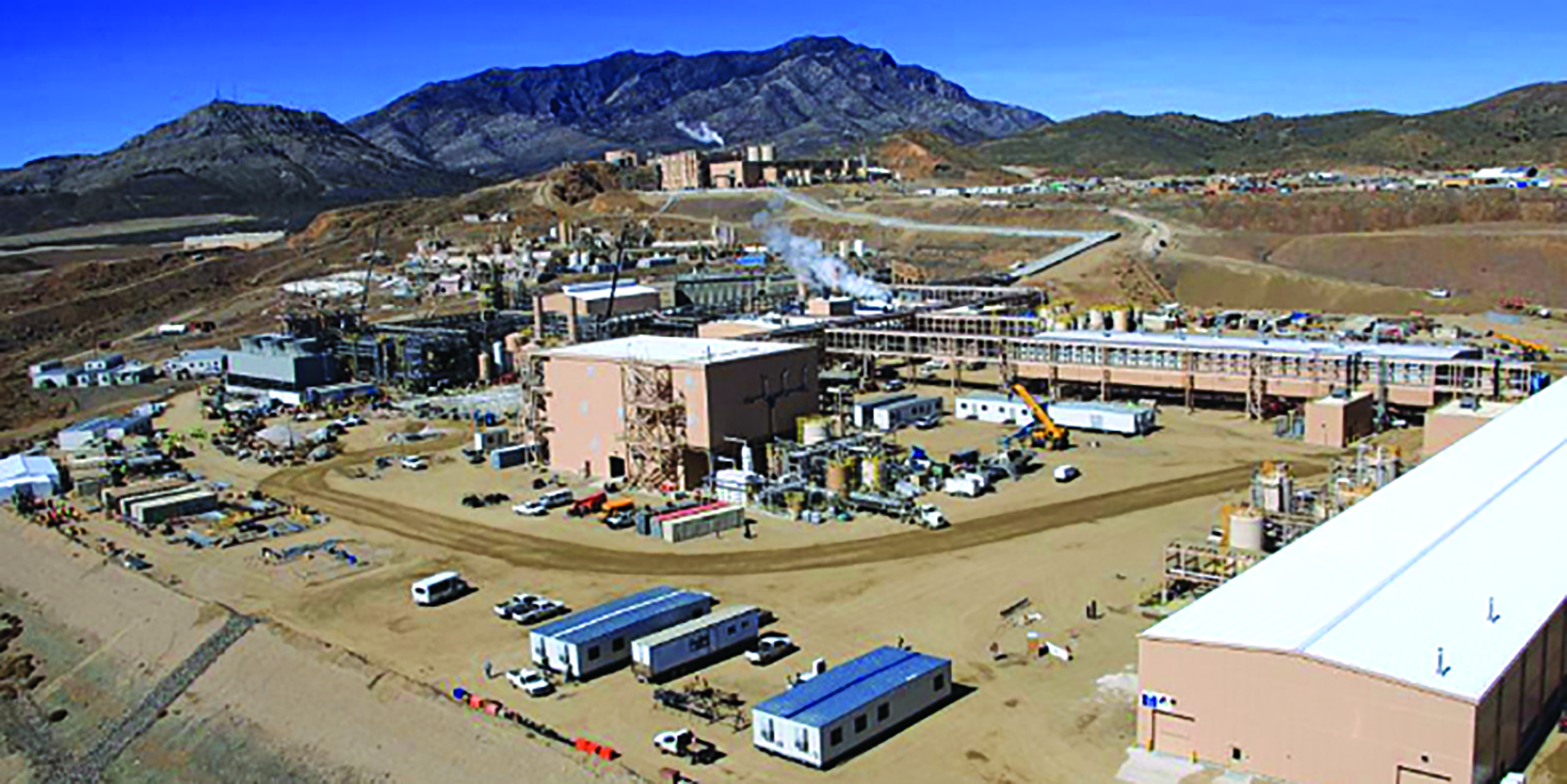

Saskatchewan-based PotashCorp operates six potash mines, accounting for about 20% of world potash capacity. Agrium operates one mine and has a retail distribution network encompassing more than 1,400 facilities worldwide. When combined, the new company will have about 20,000 employees (Photo: PotashCorp)

Kinross Provides Updates on Bald Mountain, Tasiast and Maricunga

Kinross Gold gave updates on the operating status of its Bald Mountain mine in Nevada, Tasiast mine in Mauritania, Maricunga mine in Chile:

At Bald Mountain, Kinross has received a record of decision (RoD) from the U.S. Bureau of Land Management allowing increased exploration activities and a potential expansion of the mine. The RoD provides flexibility for future growth, including the potential addition of heap leach capacity and a carbon adsorption plant, beyond what is required in the current mine plan. The decision also allows the company to complete a modest infill and metallurgical drilling program and to construct and operate new facilities in the North and South areas of the Bald Mountain land package.

Kinross is focused on developing two sets of deposits at Bald Mountain: the Vantage Complex and Yankee pits in the South area and the Saga and Duke pits in the North area. Developing these deposits has the potential to substantially increase Bald Mountain’s current reserve estimate of 1.1 million oz of gold and to extend the mine’s life.

Kinross plans to develop two sets of deposits at Bald Mountain, which is the largest mine site in the U.S. by area. These include the Vantage Complex and Yankee pits in the South area and the Saga and Duke pits in the North area. (Photos: Kinross Gold)

At Tasiast, Kinross resumed normal mining and processing operations in mid-August, following a temporary suspension caused by an expatriate work-permit issue. The company has also awarded two major construction contracts for earthworks and concrete works for the Tasiast Phase One expansion project.

Kinross and the government of Mauritania resolved the expatriate work permit issue as part of reaching a mutually acceptable “Mauritanization” plan to increase the number of local workers who have the necessary skills and experience to work at Tasiast, a requirement under Mauritanian law.

At Maricunga, Kinross has suspended mining and curtailed processing operations. The cutbacks were implemented after a judicial decision concluded that the Chilean environmental regulatory authority’s (SMA’s) revised June 24 sanction was enforceable. The sanction, among other things, substantially reduced water pumping at Maricunga.

Kinross said it continues to oppose the SMA’s actions and has various appeals pending with Chile’s Environmental Tribunal.

The Atacama Region, where Maricunga is located, has suffered from a protracted drought for many years, resulting in a drop in groundwater levels across the region that is unrelated to the mine’s operations.

As a result of the suspension, Kinross is reducing its mining and crushing workforce at Maricunga by approximately 300 employees. The company will continue to explore further permitting efforts and review the operation and its mineral resource model to consider possible options for re-starting mining.

At December 31, 2015, the Maricunga mine had estimated proven and probable mineral reserves of 1.042 million oz, estimated measured and indicated mineral resources of 4.275 million oz, and estimated inferred mineral resources of 1.053 million oz of gold.

The suspension at Maricunga is not expected to affect Kinross’s 2016 production and cost guidance, which stands at 2.7 million to 2.9 million gold equivalent oz produced at all-in sustaining costs of $890 to $990/oz.

Following an unfavorable court decision that affected the mine’s access to water, Kinross suspended mining and curtailed processing at Maricunga in Chile.

Freeport Selling Gulf of Mexico Assets

As part of a corporate effort to focus more closely on copper production, Freeport-McMoRan’s oil and gas subsidiary, Freeport-McMoRan Oil & Gas, has entered into an agreement to sell its Deepwater Gulf of Mexico assets to Anadarko Petroleum for total cash consideration of $2 billion and up to $150 million in contingent payments. The contingent payments would be received over time as Anadarko realizes future cash flows in connection with Freeport’s recently completed third-party production-handling agreement for the Marlin platform. Anadarko will also assume future abandonment obligations associated with the properties, which had a book value of approximately $500 million at June 30.

The transaction has an effective date of August 1 and is expected to close in the fourth quarter of 2016, subject to customary closing conditions.

Freeport is the world’s largest publicly traded copper producer and the world’s largest producer of molybdenum. Assuming completion of the sale of its Deepwater Gulf of Mexico properties, the company will continue to have established onshore and offshore oil production facilities in California, natural gas production from the Madden area in central Wyoming, and a position in the Inboard Lower Tertiary/Cretaceous natural gas trend onshore in south Louisiana.

Commenting on the sale, Freeport President and CEO Richard C. Adkerson said, “We are pleased to announce this transaction, which brings our total 2016 asset sale transactions to more than $6 billion and reflects our commitment to debt reduction and our focus on dedicating our capital and management resources to our global-leading copper business. With our announced asset sale transactions combined with cash flows from operations and previously announced at-the-market equity transactions, we are on track to achieve our stated balance sheet objectives.”

For the 12-month period ended June 30, net daily sales volumes from Freeport’s Deepwater Gulf of Mexico properties averaged approximately 73,000 barrels of oil equivalents. Over this period, revenues totaled $1 billion, cash production costs before G&A totaled $300 million, and capital expenditures totaled $1.6 billion.

Regarding the transaction, Anadarko Chairman, President and CEO Al Walker said, “This immediately accretive, bolt-on transaction strengthens our industry-leading position in the Gulf of Mexico and is a catalyst for the company’s oil-growth objectives, with quality assets being acquired at an attractive price to create significant value.”

Molycorp Emerges From Bankruptcy, Leaves Mine Behind

Molycorp Inc. and certain of its affiliates emerged from Chapter 11 bankruptcy protection at the end of August. The newly reorganized company, now known as Neo Performance Materials, includes Molycorp’s downstream rare earths processing and distribution facilities, but does not include its Mountain Pass, California, rare earths mine and processing facilities, which were placed on care and maintenance in 2015. Mountain Pass remains in Chapter 11 under a separate bankruptcy proceeding.

Neo Performance Materials is organized into three business segments: Neo Chemicals and Oxides, Neo Magnequench, and Neo Rare Metals. The business operates globally with sales offices and production facilities in 10 countries: Japan, China, Thailand, Estonia, Singapore, Germany, the United Kingdom, Canada, the United States and South Korea.

The company produces rare earth and zirconium-based engineered materials, magnetic powders, and rare metals that are used in a wide range of technology applications across many sectors, including consumer electronics, fiber optics, hybrid and electric vehicles, and clean energy technologies.

Neo Performance Materials is a privately held company with executive offices in Toronto, Canada, and is composed of a number of operating subsidiaries organized under a holding company based in the Cayman Islands. It is led by the prior Molycorp management team under Geoff Bedford, president and CEO.

Shares of common stock of the former Molycorp Inc. are no longer available for trading. Previous shares of common stock have been canceled with no distribution to the holders.

Bedford said, “We emerge with a strong financial foundation under a new brand that speaks to our continued focus on performance and innovation. We have a commonality with the funds managed by Oaktree Capital Management, an affiliate of which is our largest shareholder, in a shared vision and commitment to our customers with the goal of long-term growth and value creation that will benefit everyone associated with our company … We are already achieving significant milestones in bringing new applications and solutions to market through collaboration with our customers, and we are now in a much stronger position to continue down this path of value creation for our stakeholders.”