On November 28, Rio Tinto revealed a “breakthrough pathway” that will allow it to rapidly expand its iron ore production in the Pilbara region of Western Australia at significantly lower capital costs than previously anticipated. A day later, on November 29, the company announced that it will suspend production at its loss-making Gove alumina refinery in Australia’s Northern Territory but that it will continue production at the Gove bauxite mining operation.

|

| Rio Tinto has approved $400 million for plant equipment and modification and for additional heavy machinery in support of its strategy to focus on expanding iron ore production by increasing output from existing mines. |

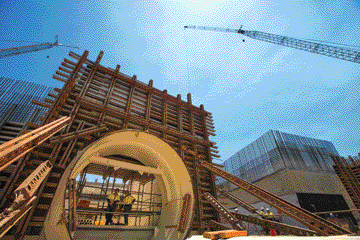

Iron Ore Expansion: Rio Tinto has developed plans for near-term expansion of its Western Australia iron ore production based on series of low-cost, brownfield expansions of existing mines. From a base run rate of 290 million mt/y at the end of the first half of 2014, the company expects these expansions to lift its production to 330 million mt/y in 2015 and to more than 350 million mt/y by 2017. The added iron ore production will come from multiple mines, including Brockman 2, Brockman 4, Yandicoogina, Paraburdoo and West Angelas.

In support of the brownfield expansions, Rio Tinto has approved $400 million in capital expenditure for plant equipment and modification and for additional heavy machinery. The additional production will be achieved at all-in capital intensity of $120 to $130/mt, including the cost of infrastructure.

Rio Tinto Chief Executive Sam Walsh said, “The breakthrough pathway we have identified, combining brownfield expansions and unleashing low-cost productivity gains, means we will deliver the expansion at an estimated capital cost of more than $3 billion below previous expectations.”

Rio Tinto is deferring an investment decision on the proposed Silvergrass mine until the third quarter 2014 at the earliest, and on the proposed Koodaideri mine until 2016 at the earliest.

Gove Refinery Suspension: In announcing its planned suspension of production at the Gove alumina refinery, Rio Tinto stated that the refinery is no longer a viable business in the current market environment. Continuing low alumina prices, a high Australian dollar exchange rate, and substantial after-tax losses despite considerable efforts to improve refinery performance all contributed to the decision.

Consultation with employees and the local community will be the priority as the company works with the Northern Territory and Australian federal governments, traditional owners and all other stakeholders to minimize the economic impact of the refinery shutdown. Establishing a long-term plan for the bauxite operation and its employees will be the key to Rio Tinto maintaining a sustainable business in the area.

“The suspension process will take some time,” the Rio Tinto announcement said. “Rio Tinto will be consulting with employees and the community in coming weeks to develop detailed plans regarding the timing and phases for ramping down the refinery. There will be no immediate change to refinery operations. At this early stage, it is expected the process of suspending production would start in the first quarter of 2014 and be phased during the remainder of the year.”

The Gove mine produced 5.758 million mt of bauxite and the alumina refinery produced 1.597 million mt of alumina during the first three quarters of 2013.