Sibanye Gold announced on December 11 an offer to acquire Witwatersrand Consolidated Gold Resources for approximately R407 million ($39 million) in cash. Sibanye Gold CEO Neal Froneman said, “Wits Gold owns significant exploration and project areas in the Wits Basin, containing approximately 157 million oz of gold resources. More importantly, its advanced De Bron Merriespruit and Bloemhoek projects in the Southern Free State are adjacent to Sibanye Gold’s Beatrix operations and offer an opportunity to extend the operating life of Beatrix and unlock significant value in the region. This is consistent with Sibanye Gold’s strategy of extending its life-of-mine production profile in order to sustain its industry leading dividend yield in the long term.”

|

| Sibanye Gold’s Beatrix operations are adjacent to Wits Golds’ De Bron Merriespruit and Bloemhoek projects in the Southern Free State. |

Wits Gold was formed in 2003 with the aim of acquiring properties adjacent to operating mines within the goldfields of the Wits Basin in order to quantify their exploitable resources. This focus served to build a comprehensive and unique geological understanding of the Wits Basin and led to the development of the De Bron Merriespruit and Bloemhoek projects.

Wits Gold also holds uranium resources at Beisa North and South, adjacent to Beatrix West, which have potential to be developed into a uranium producer.

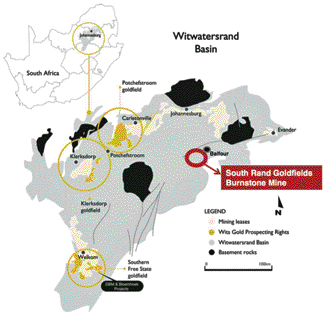

Also, on July 4, 2013, Wits Gold submitted a binding offer for the acquisition of Southgold Exploration, which owns the Burnstone mine on the South Rand goldfield. Southgold is currently subject to business rescue proceedings following the commencement of the liquidation of Great Basin Gold Ltd. in September 2012. Wits Gold has since advanced a suite of agreements, including transaction and refinancing agreements, that are expected to be executed shortly.

Burnstone is a shallow, semi-mechanized mine containing a 6.4-million-oz reserve and 21.7-million-oz resource. Mine construction started in 2006 and mine infrastructure is 90% complete, with approximately $800 million already spent on establishing the mine.

Commenting on Sibanye’s possible acquisition of Burnstone, Froneman said, “Burnstone potentially secures an additional source of low-cost production, thereby enhancing Sibanye Gold’s existing production profile and shifting its operating profile toward shallower operations, as well as establishing a new operational base in the South Rand goldfield.”

Sibanye’s final decision to invest in Burnstone will be subject to implementation of the proposed transaction and the outcome of a final due diligence investigation of Burnstone by Sibanye.