The headframes at the Ust-Yayvinsky mine represent the beginning of $1.9 billion investment to add 2.5 million mt/y of KCI.

The headframes at the Ust-Yayvinsky mine represent the beginning of $1.9 billion investment to add 2.5 million mt/y of KCI.Recovering from the Solikamsk No. 2 flooding and other issues, the company charts a new course forward

By Vladislav Vorotnikov

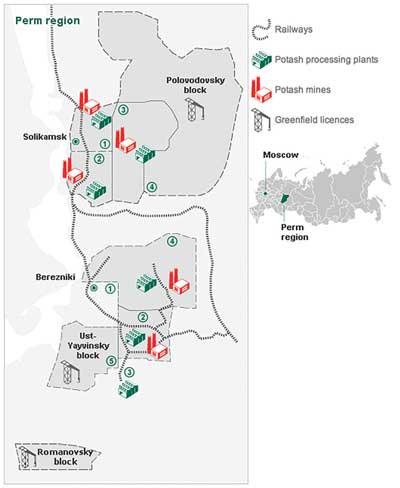

The world’s largest potash producer Uralkali plans to invest $4.5 billion during the next five years to implement a new development strategy to improve efficiencies and marketing structure, and increase its production capacity from 11 million metric tons per year (mt/y) of potassium chloride (KCl) in 2014 to 14.4 million mt/y of KCI in 2020. Employing more than 10,000, the company operates five mines and seven mills, located near the towns of Berezniki and Solikamsk in Russia’s Perm Region. Management is planning radical reforms for almost all aspects of Uralkali’s operations, as the company tries to distance itself from numerous past problems.

Dmitry Osipov, CEO, Uralkali.

During March, Uralkali adopted a new investment strategy to grow production. It had to abandon its previous plan to increase production capacity to 19 million mt of KCl by 2021 when its Solikamsk No. 2 mine suddenly flooded a little more than a year ago. The brine inflow caused a major sinkhole to form and collapse in a populated area, which created a huge negative public outcry. Some summer cottages fell into the sinkhole, but no lives were lost.

Mining at Solikamsk No. 2 was suspended and the incident reduced the company’s production capacity by 18%. By the end of 2014, the company had incurred a huge loss, which erased any hopes for a profit. In 2013, the company posted a profit of nearly $670 million.

While the fallout from the Solikamsk No. 2 incident was bad, Uralkali has other problems. Russian natural resource companies have suffered as the ruble lost value against the U.S. dollar. And, a trade conflict with the Belarusian Potash Co. (BKK), which created a firestorm for the potash market, has forced the company to find a new strategy for international marketing.

“During the first half of 2015, the potash market faced the twin challenges of a tough agricultural environment and inventory drawdown after a solid buildup last year,” said Dmitry Osipov, CEO, Uralkali. “Modest demand and strong competition among suppliers put pressure on the prices in the spot markets. A challenging market together with Uralkali’s decreased capacity resulted in lower sales and revenue volumes for Uralkali.”

Trying to move on from the Solikamsk No. 2 incident, the company is now focused on its 300 billion ruble ($5.8 billion) capacity development program.

SOLIKAMSK NO. 2 FLOODING

By mid-December 2014, the size of the sinkhole, which appeared to the east of the Solikamsk No. 2 mine, had nearly doubled. In less than one month, it had increased to 50 x 80 m from 30 x 40 m. During the same time period, the brine inflow into the Solikamsk No. 2 mine had increased to more than 700 m3/hr.

Uralkali had an accidental liquidation plan and initiated comprehensive monitoring of the situation: water inflows were monitored through brine levels checks; additional water monitoring wells were drilled; gas levels were monitored around the sinkhole using drones and in the mine; and seismologic stations were established around the sinkhole area.

Underground miners were pumping brine from the inflow area in the eastern part of the minefield to the western part of the minefield to prevent flooding in the area adjacent to the shaft. A brine diversion channel was built for the same purpose. The company also initiated work to strengthen the hydro-isolation of the seals between Solikamsk Nos. 1 and 2 minefields. The company began backfilling the worked-out areas of the mine to reduce rock mass deformation. Uralkali tamped channels to slow the brine inflow into the mine.

At the time, Yevgeny Kotlyar, Uralkali’s chief engineer, said they were taking all necessary measures to save the Solikamsk No. 2 mine and minimize the consequences.

RESETTING PRODUCTION CAPACITY

The biggest issue for this year is how the Solikamsk No. 2 flooding will affect Uralkali’s operational results, and if the company would be able to get this mine back into production. So far, it seems that Uralkali has succeeded in maintaining production from the Perm region. According to the company’s production figures for the first nine month of 2015, it reduced the production of KCl only by 5.4% compared to the same period last year. During this period, the company produced 8.7 million mt of KCl against 9.2 million mt in the same period of 2014. In the third quarter, the company produced 3 million mt of KCl compared to 3.2 million mt in the third quarter of 2014.

A sinkhole at Solikamsk No. 2 swallows summer cottages.

A sinkhole at Solikamsk No. 2 swallows summer cottages.Management has reconsidered its target production for 2015. Initially, Uralkali planned to produce only 10.2 million mt of KCl against 12.1 million mt in 2014, but after six months, the outlook was raised to 10.4-10.8 million mt. In August, Uralkali revised the production forecast upward once again, as management announced that the company planned to supply 11.5 million mt of KCl to maintain its global market share, which accounted for 19% in 2014.

The company’s current investment strategy will gradually restore production capacity to 11 million mt of KCl in 2016 and 12 million mt by 2018. Market analysts believe that in general this forecast seems too pessimistic, and the company probably will raise them again.

“With the second quarter of this year, we see that the Uralkali managed to almost fully restore the production at Solikamsk No. 2,” said Elena Sahnova an analyst from VTB Capital. “The inflow of salt brine has stabilized.”

At the same time, Uralkali also is not rushing to raise the production forecast and probably will not do it until the end of the year, or at least the end of the negotiations on the price for supplying KCl to China. The average price currently stands at $315/mt and bringing more product to market would only cause prices to soften.

NEW INVESTMENT FOR GROWTH

The company’s new development strategy launches new capacities to bring an additional 3.8 million mt/y of KCI online by modernizing operational facilities, which will let Uralkali boost their output by another 1.4 million mt/y. One of the more important parts will be the $723 million Solikamsk

No. 2 reconstruction project. Many of the relevant projects were launched in 2015 and they involve construction of a new mine with two shafts by 2020 with a capacity of 2.3 million mt/y of KCl. The object is to safely mine the remaining Solikamsk No. 2 reserves, which are estimated at 86 million mt of KCl.

At the same time, by 2018, the company will lose part of its production capacity as resources are exhausted at Berezniki No. 2. Production at this mine will decrease and gradually cease in the near term, resulting in a 2-million-mt/y KCl production loss.

Uralkali plans to expand the Solikamsk No. 3 mine. The project involves completion of cargo and ventilation Shaft No. 4 with two hoist machines. During Soviet times, Shaft No. 4 was sunk to the depth of 356 m. Uralkali plans to sink the shaft further to 481 m. Once Shaft No. 4 is complete, a pit-bottom paddock and loading complex will be constructed, along with a set of modern conveyors both underground and on the surface to transport potash. The Solikamsk No. 3 project should increase production capacity by 600,000 mt by 2017-2018 with an overall investment of $135 million.

The biggest project for Uralkali, however, is the development of the Ust-Yayvinsky block of the Verkhnekamskoye deposit, which includes the construction of a new mine with two shafts. Uralkali has decreased its original timeline for implementation of this project by one year. The deadline for the commissioning of the first stage of the complex has shifted from 2017 to 2016. The overall capacity of Ust-Yayvinsky is 2.5 million mt/y of KCl. With an estimated cost of $1.19 billion, it is the most expensive part of the company’s new growth strategy.

Uralkali has another project of similar size, development of Polovodovo mine, but it is not included in the development strategy for 2020. The potential capacity of the mine is 2.8 million mt/y of KCl and it is expected that its development may be launched in 2018-2019 and finished after 2020. Potentially, it may bring the overall volume of production of KCl by the company to 17.2 million mt/y. The cost of the project could be as much as $1.6 billion, and the company may not have the capital for its implementation alongside all of the other expansion projects. At the beginning of 2014, Uralkali had $4.1 billion in debt that will come to term sometime in the next few years.

In addition to these projects, the company has targeted an increase in the extraction ratio of potash from the sylvinite ore. They will also increase output in in circuits at the Berezniki Nos. 3 and 4 plants. Existing equipment will be upgraded or partially replaced with more technologically advanced options. These projects, which amount to $87 million, could yield an addition 800,000 mt/y of KCl by the end of 2016.

MINING MACHINE UPGRADES

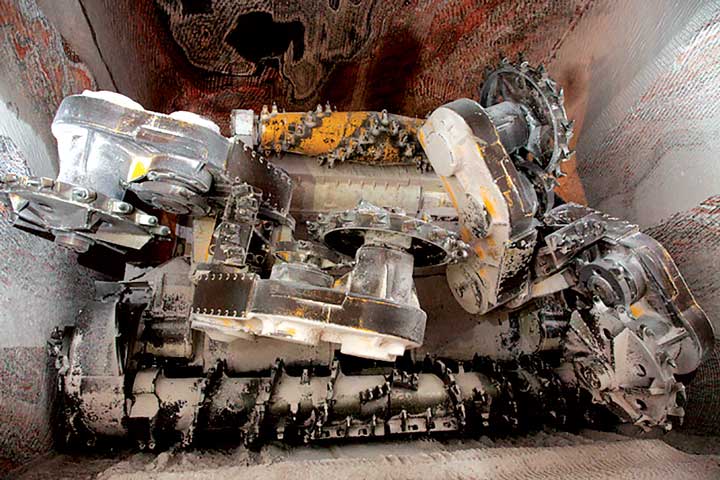

At the end of June, the company put two modernized Ural-20P continuous mining machines, or combines as the Russian miners refer to them, manufactured by Kopeysk Machine-Building Plant into operation. The new mining equipment was developed as part of a program to increase the output of combines to 1 million mt/y of ore per machine. The new machines are capable of cutting 8 mt/min–1 mt/min more than the previous Ural 20P model. The operating life has also been increased by 300,000 mt of ore to 1.8 million mt.

Nine major parts have been updated. The undercarriage has been overhauled. More modern and reliable hydraulic motors have been installed. The gearboxes have been reinforced and the cutting unit has been modernized. An electronic control panel has also been installed in the operator’s cabin and the cabin is equipped with a dust control system.

The new units are currently operating at the Berezniki No. 4 and Solikamsk No. 3 mines.

“Increasing output in the mines is not possible without also increasing the operating life of the combines,” said Eduard Smirnov, the first deputy technical director of mining operations for Uralkali. “The introduction of more productive and reliable machinery leads to improved safety and increased mining efficiency.”

A total of 121 combines are currently in operation in Uralkali’s five mines.

TESTING BEGINS ON THE URAL-360

During September, testing began on the Ural-360 shaft-sinking and tunnel-boring machine—a fundamentally new piece of mining equipment that has not yet been used to extract sylvinite ore at Uralkali’s mines. The main difference is the shearing unit breaks the ore. The new combine cuts through the solid layers with a special drum. The Ural-20 series used disks.

The company plans to use the machines for mining, development work and the extraction passages for the stopes. The new technology will allow the company to extract ore from the lower seams. “The Ural-360 combine will be able to cut through various different seams, meaning the company can mine reserves that it was unable to extract with previous equipment,” Andrey Kharintsev, head of mining for Uralkali said. “The experiment will last several months, and we hope that the new machinery will justify its use. Testing the equipment underground allows the mechanical engineers to develop prototypes that could be commercially produced in the future.” The Kopeysk Machine Building Plant manufactured the new combine specifically for Uralkali.

The company plans to purchase eight continuous miners, eight feederbreakers, 10 shuttle cars, 11 LHDs, saying that it would spend more than 1.5 billion rubles on new mining equipment.

UST-YAYVINSKY SHAFT TUBBING

Uralkali recently completed a 273-m-shaft-tubbing project, where a circular a shaft is lined with ductile cast iron, on Skip Shaft No. 1 at the Ust-Yayvinsky mine. The column consists of 182 cast-iron rings, which will minimize the impact of the rock pressure and ensure the safe operation of the shaft in the event of contact with water-bearing layers. Sinking operations will continue down to 467 m. Completion of Skip Shaft No. is scheduled for 2017.

Sinking operations are also in progress for Cage Shaft No. 2, which is designed to transfer people and cargo. The shaft has been sunk more than 372 m and the installation of the tubbing lining will begin soon. It will also be completed in 2017.

Construction of a hoist-engine house, step-down power substation, and administration and housing building began at the Ust-Yayva production site. The foundation for a 6.3-km conveyor belt to transport potash ore to the Berezniki No. 3 plant is under way. The company has also recently invested in electrical upgrades for these facilities as well.

In December 2011, Uralkali signed a contract with Deilmann-Haniel Schachtostroj for the construction of the shafts at the Ust-Yayvinsky mine. Miners began sinking Shaft No. 1 in 2013. The mine will produce the first ore in 2020 and will enable Uralkali to replace the depleting ore reserves of the Berezniki No. 2 mine.

SALES OPTIMIZATION

Profitability for Uralkali has not only suffered from the company’s production losses, but also with the negative conjecture related to global markets. Over the last three years, the price for KCl dropped from the peak of nearly $1,000/mt to $315/mt and Uralkali played a significant role in driving the market to the brink of collapse.

Osipov was appointed CEO in December 2013 replacing the former CEO Vladislav Baumgertner who withdrew Uralkali from BKK, which marketed potash for both Uralkali and state-owned Belaruskali, and this dispute caused the potash market to crash. He was jailed in Minsk for refusing to cooperate and later extradited and placed under house arrest in Russia. Belarus has dropped its charges against Baumgartner, but both companies blame each other for undercutting and low prices.

Uralkali today accounts for 20% of potash supplies and it ships potash to 60 countries. While the company has maintained its shipments to Brazil, the U.S. and Europe, and increased its deliveries to other Latin American countries, it has reduced the amount it ships to China and Southeast Asia.

Uralkali is now actively working on a number of projects related to distribution in key sales markets. To optimize logistics spends, the company will reduce the share of the containers as they now have more capacity to load and unload ships.

IMPROVING EFFECTIVENESS

At the same time, within the period of the implementation of the new investment plans, the company may also go through a number of structural changes. First of all, in the next several years, Uralkali is going to cut the staff by nearly 20% in order to catch up with its main competitor Canadian PotashCorp, according to Uralkali CFO Anton Vishanenko.

“In terms of improving the effectiveness, Uralkali looks at the experience of PotashCorp. We employ about 10,000 people, while they have only 3,000 people, and the output they have is not much less,” he said.

In addition, he added that to boost effectiveness, the company is implementing a program of import substitution. For example, the management of the Uralkali has already reached an agreement with one of the Russian factories for the supply of amine concentrators. So far, this product has not been manufactured in Russia.

According to management, the supplies of the domestic-made amine concentrators will let Uralkali avoid the risks of currency fluctuation, and in addition will keep it safe from any political risks. In the beginning of 2015, there were rumors that within the sanctions against Russia, western companies might ban the supply of industrial equipment. Among others, it was believed that this step would affect Uralkali who imports certain types of equipment for its facilities.

However, the most important change is the possible merger of Uralkali with the local chemical giant Uralchim. The negotiations on the issue have been taking place since the beginning of the 2015, which has been repeatedly confirmed by anonymous sources from both companies to the Russian media. Official confirmation or refutation has not followed.

The reason for the merger could be the integration of the marketing and sales structure in Asia and Latin America, which could bring mutual benefit. The deal has required the delisting of Uralkali, and since the middle of 2015, it conducted the payback of 21.98% of shares for the total value of $2.1 billion. Currently, there’s only 13.9% of all shares that are in free trade at the London Stock Exchange, which is lower than the minimum required amount of 25%.

The payback of shares has raised the confidence of investors that the merger is on the way. However, so far, no regulatory authorities have received the request for such deal. If the deal were allowed to take place, it would happen in the first half of 2016.