After posting a huge loss and reclassifying reserves, a new CEO charts a course with organic growth and a decentralized approach

By Steve Fiscor, Editor-in-Chief

Goldcorp’s new CEO David Garofalo took the helm at the end of February, shortly after the gold mining company posted a $4.2 billion loss for 2015, revised its production guidance downward and reclassified millions of reserve ounces as resources. He was serving as president and CEO of HudBay Minerals when the Goldcorp board approached him. He presided over HudBay’s emergence as a leading metals producer. Before joining Hudbay, he served as a senior vice president, finance, and CFO with Agnico-Eagle Mines from 1998 to 2010. So, he’s familiar with the gold business.

Goldcorp’s new CEO David Garofalo took the helm at the end of February, shortly after the gold mining company posted a $4.2 billion loss for 2015, revised its production guidance downward and reclassified millions of reserve ounces as resources. He was serving as president and CEO of HudBay Minerals when the Goldcorp board approached him. He presided over HudBay’s emergence as a leading metals producer. Before joining Hudbay, he served as a senior vice president, finance, and CFO with Agnico-Eagle Mines from 1998 to 2010. So, he’s familiar with the gold business.

Making no excuses, Garofalo said he is pleased with the company he has inherited. “Goldcorp is a rock solid 3-million-ounce-per-year (oz/y) producer with low cash costs, mining gold in low political risk jurisdictions,” Garofalo said. “It’s got the best balance sheet in the space. What positively surprised me about the company was the robust organic pipeline of projects. We have up to eight opportunities to optimize existing operations. These projects have a relatively low capital intensity because they can be found within the shadow of existing headframes. We can leverage the existing infrastructure and the people we have in place, which means lead times are much shorter and the internal rate of return (IRR) is robust as well.”

Because the company has a strong balance sheet with significant free cash flow, it has the ability to comfortably finance these projects while continuing to de-leverage its balance sheet, Garofalo explained. “We have some of the lowest leveraged levels in relative terms—the lowest in the space among the seniors,” he said. “We have further opportunities to comfortably rebate that and finance organic growth without going back to the market. That also affords compound returns. We will harvest and generate returns from the significant buildout undertaken in the last few years and now we are able to compound those returns in low capital-intensity, high-IRR propositions that we already own.”

At this time, growth through mergers and acquisitions is not as appealing to Goldcorp. “We have surveyed the landscape of available opportunities,” Garofalo said. “Our best opportunities are the ones we already own. We’re very selective geographically and geologically. We want to work in low political-risk jurisdictions and we want to stay focused on gold. Because of our scale, we need 5-million-oz deposits to perpetuate our business and shovel-ready jobs of that scale are few and far between. They just don’t exist in the jurisdictions where we want to operate.”

While it focuses internally, Goldcorp will cultivate the next generation of large-scale gold projects as it moves forward by placing seed capital with multiple juniors. That’s a strategy that Garofalo pursued at HudBay and Agnico Eagle. He sees greenfield exploration as the highest risk factor of the value creation equation for the mining business. During his tenure at HudBay, five of the mines that they developed resulted from a portfolio of investments where the company put capital to work with multiple juniors.

Once a successful junior has de-risked a project significantly, Goldcorp will cut them in by marrying the assets with its strong balance sheet and mine construction and operations expertise. “Cultivating those 5-million-oz deposits will require a patient approach toward investment,” Garofalo said. “As an industry, we have no other choice because these projects do not exist.”

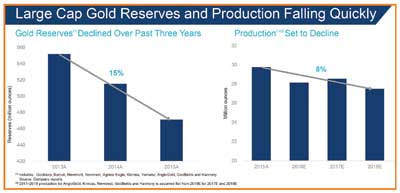

Comparing Goldcorp with its peers, over the last three years, the reserves for the top 10 producers have decreased 15% and production is projected to decline by 8%. “Flat is the new growth in our sector,” Garofalo said. “Having a flat production profile with the potential upside of an organic pipeline of opportunities, puts us in an excellent competitive position.”

A Significant Reset

A Significant Reset

Seeing the direction they were heading, with gold prices languishing between $1,150/oz and $1,250/oz, the company re-evaluated its situation using a more practical long-term gold price of $1,100/oz rather than $1,300/oz. Its proven and probable gold reserves decreased by 18% to 41 million oz. The decrease in reserves was driven primarily by 5.3 million oz of low margin reserves being reclassified to resources at Los Filos.

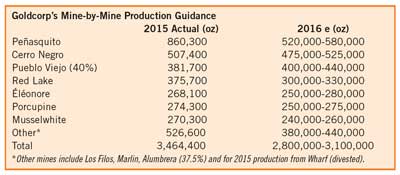

For 2015, Goldcorp produced 3.46 million oz and all-in sustaining costs (AISC) were $894/oz including inventory impairments. Excluding organic growth projects, annual gold production guidance for the years 2016-2018 will now range between 2.8-3.1 million oz at AISC between $850/oz and $925/oz.

So, why did Goldcorp need to reset expectations so significantly? “There were three distinct issues within our portfolio that we needed to address and we needed to build in sufficient contingency for the inherent risk,” Garofalo said. Top of the list was Cochenour. Goldcorp acquired the Gold Eagle mine about eight years ago under the expectation that there would be a 5-million-oz deposit there. “That figure was extrapolated from limited drilling,” Garofalo said. “Mother Nature has a way of humbling you in the mining business. Clearly in Cochenour’s case, when we got underground, the geology was much more complex. The orientation was different from what we expected.”

Cochenour will require additional work. “It’s not a lost cause,” Garofalo said. “Ultimately, we will produce gold there. Right now we do not have a clear enough line of sight into the resource profile to perform a proper engineered block model.”

Goldcorp had included production from Cochenour in its long-term guidance, Garofalo explained, but it had insufficient engineering to support that decision. “We had to take a step back and reboot in a way,” Garofalo said. “We have invested $500 million in development capital and rehabilitated the Cochenour shaft. We are drifting along the tram level right into the heart of the deposit. We are in it drilling and sampling. We will have a better understanding of how the ore performs, which will increase the confidence in the resource. Then we will be able to build a block model.”

Once they understand the geology, the capital intensity to bring production online at Cochenour will be considerably lower. “It’s not all bad news at Cochenour, but we need time to define the deposit and the economics to make the investment case,” Garofalo said. “By the middle of this year, we will have a definitive game plan.”

Éléonore has also turned out to be a bit more challenging geologically than Goldcorp expected. About 10% of the deposit has complex folding and faulting features. That 10% of the deposit contains about 40% of the gold because there is a preponderance of high grade gold around the folding and faulting. “We had to build the actual realized dilution into our mine plan going forward,” Garofalo said. “We have a plan to bring that dilution back down to our original reserve model, but until we do, we can’t overlook it in our projections going forward. We had to take a bit of a haircut in our production guidance from Éléonore.”

‘Haircut’ would be a nice segue for a discussion of Los Filos in Mexico. Gold production at Los Filos during the fourth quarter was 74,400 oz at an AISC of $2,131/oz. “Because of lower gold prices, we had to reclassify a large portion of the reserves into resources,” Garofalo said. “After adjusting to $1,100/oz, those pit laybacks just didn’t make sense, especially with some of the geotechnical issues we have been experiencing there. The strip ratios doubled from

what was originally anticipated. Those ounces are not lost; they are still in the resource category. Ultimately, we think we will be able to bring those ounces back into reserves either through higher gold price or trying to find ways to economize operating costs and lowering the economic cut-off.

“At Los Filos, we will have to find ways to bring those costs down,” Garofalo said. “We think we can do that. Our social payments are high. We pay more than $100/oz to local communities. At the current reserve profile, we have less than five years of mine life remaining. There might be some scope to revisit those community payments to sustain operations. There are other efficiencies that we could engineer into the operation as well.”

The Organic Growth Upside

The Organic Growth Upside

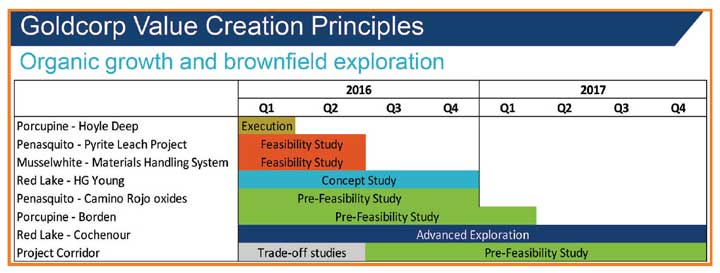

Goldcorp has eight projects in various stages of execution. They could add appreciably to the company’s production profile and in seven cases improve the

existing mine’s net asset value (NAV). The exception would be Corridor, which is a greenfield project. “All of these projects offer the opportunity to build new pro-

duction with low capital intensity,” Garofalo said.

As an example, the Hoyle Deep project consists of material-handling improvements combined with a new internal shaft (winze), which will allow the mine to expand production by 40% over time.

At Peñasquito in Mexico, the Pyrite leach project will retrieve precious metals currently reporting to tailings through the use of enhanced recovery processes.

“Again, this is a relatively low capital investment and we expect to make an investment decision on that by the middle of 2016, and it will add to the production profile within five years,” Garofalo said.

Goldcorp plans to install a winze at Musslewhite in Canada to improve efficiency and extend the mine’s life. That’s counter-intuitive, as a higher mining rate would shorten a mine’s life. However, economies of scale will lower the economic cut-off for the mine, which will move some of the resource ounces into the reserve category. It’s also a compelling economic proposition, Garofalo explained, and the company expects to make a decision by midyear.

Garofalo places Red Lake’s HG Young and Cochenour projects in the same category. Both projects access high-grade deposits within an existing complex and allow the operation to extend high-grade mining beyond the end of this decade. “Our existing high-grade zone is defined through the end of this decade,” Garofalo said. “Ideally, we want to sequence HG Young and/or Cochenour to begin after that to perpetuate high grade mining at Red Lake and make efficient use of the infrastructure there.”

Camino Rojo is expected to be a stand-alone oxides heap-leach operation 50 km from Peñasquito. It is another high IRR proposition that would add to the company’s production profile within its five-yr horizon. Goldcorp acquired the Borden project in Timmins, Ontario, a location where they have spare concentrator capacity as the company has exhausted reserves at the 100-yr-old Dome underground mine. “All of these projects are quick and relatively inexpensive to build and they will generate high IRRs,” Garofalo said.

Cerro Negro Benefits From Regime Change in Argentina

Cerro Negro Benefits From Regime Change in Argentina

Argentina’s new President Mauricio Marci made immediate changes upon taking office that directly benefited mining operations, such as Goldcorp’s Cerro Negro mine. “Up until the election, the focus was to expatriate as much capital from Argentina as quickly as possible,” Garofalo said. “Now, we are looking at opportunities to optimize exploration efforts around Cerro Negro. It’s a brand new camp and we have first mover advantages there, so we want to drill it more aggressively. We were more reticent to do that under the previous regime. Marci’s administration has already opened the economy dramatically in a short period of time. It has given us more confidence to put more capital back into the country. Even though Cerro Negro was a $1.7 billion project, it will probably end up being under-capitalized for what we are going to find there geologically.

Cerro Negro has already seen significant positive implications. The operation is benefiting from a free and floating local currency, which has devaluated 30%.

“About 70% of our operating costs at Cerro Negro are denominated in local currency,” Garofalo said. “So there is an immediate benefit. That is rare in Latin America. Normally, it’s just the labor costs and everything else is imported.”

Significant import controls forced Goldcorp to source locally, which has been a less-than-ideal situation. “That brought inefficiencies into our procurement processes,” Garofalo said. “We have had to pay through the nose for substandard materials from substandard suppliers. As they relax import controls, we can get the best supplies at the best prices. So we expect to see significant efficiency improvements in our procurement process going forward.”

Shareholder Confidence

Shareholder Confidence

Mathematically, the decisions make sense on paper, but how would shareholders view these decisions? “Look, in the fourth quarter, we underperformed by 10%,” Garofalo said. “That was humbling. It was also commensurate with recent performance. We will take responsibility for that. And we will take responsibilities to ensure that it does not happen again by having the appropriate accountabilities in place.”

Goldcorp will begin transitioning away from command-and-control at the head office to a decentralized organization with accountabilities at the mine site level. “Mine managers will be entrusted with a certain amount of the shareholder’s capital,” Garofalo said. “We have to provide them with clear criteria as far as expectations. We want to push down accountability for increasing the NAV of their business by directing their exploration dollars. They have to grow the value of their business. Whatever ounces come out of that is a secondary consideration. If they are increasing the value of the business and maximizing return on capital, the ounce number will come out rather than the other way around where the ounce number drives the mine plan.”

Goldcorp is not the only gold mining company to reduce production guidance and some have offered more aggressive guidance on cost control. Does he worry that Goldcorp might get left behind if they end up at the high end of their cost guidance? “Not at all,” Garofalo said. “Each of these projects allow us to drive economies of scale. Unit costs will come down. We also used conservative exchange rates. Some of the targets put out by our competitors are more aspirational than anything based on reality.”

“We don’t want to get ahead of our ski tips again,” he said. “We want to provide achievable milestones for each of our projects. We will work very systematically in a very engineering-oriented way through each of these projects so we can make a strong case for the economics.”