African miners face serious issues to survive a challenging market

By Gavin du Venage, South African Editor

An African saying asserts that a gazelle fleeing a lion doesn’t have to outrun the predator; just the slowest gazelle. At this year’s African Mining Indaba, outlasting the weakest was very much the theme.

The Indaba took place as usual under the benign shadow of Table Mountain in Cape Town. The mood inside the convention center was unsurprisingly somber, following a terrible 2015 for the industry, with the coming year looking to be as bad or perhaps even worse. Still, there was also a sense of fortitude, that muscling through to become a leaner, more modern industry was the way forward.

ATTENDANCE DOWN, BUT INTEREST REMAINS

Indaba CEO Jonathan Moore said numbers were down from last year, to around 6,000 delegates. This is quite a tumble from the almost 10,000 who crowded in during the heady days of the commodities rush. The numbers do not show the entire picture, however, as numerous people lurked on the fringes in hotels around the convention center, setting up meetings and arranging deals.

“There are plenty of us who visit Cape Town because this is where everybody is,” said one South African junior mining executive, who asked not to be named, who was using the nearby Cullinan Hotel as a base. “I still get meetings, even though it would obviously be better to be in there,” he said, jerking his thumb in the direction of the convention center.

He added that South Africans had the double whammy of a bad year of business coupled with the fact that the entry fee was dollar denominated at a time when the South African rand, Bloomberg figures show, was one of the five worst-performing currencies in the world.

“Last year, it cost me about 16,000 rand for an Indaba pass; this year, it was closer to 23,000 rand because of the exchange rate. You can see my problem,” the executive said.

For those who did make it through the doors, there was much to discuss. Sadly, as the event got under way, word spread of an accident in which nearly 80 miners were trapped at Lily mine in South Africa’s Mpumalanga province. Most were rescued, but three remained missing. (See Regional News–Africa, p. 18)

“We do have the best proto teams on site and they are doing everything possible to find the missing workers and safely get them to surface,” Chamber of Mines CEO Roger Baxter said. “Everything possible is being done.”

Baxter noted that last year 74 miners had died in accidents around the country, down from 84 fatalities the year before.

At the same time, the state of mining itself was dire. “It’s not easy for the industry at the moment—everyone is doing what they can to survive.” More than 47,000 jobs had been lost in the past three years, and another 32,000 were at an immediate risk, Baxter said. Most of these were in the gold sector, followed by platinum.

“CEOs don’t wake up in the morning thinking about retrenching workers—their thoughts are on how to build a sustainable business.”

A major factor was that operating costs had increased 20% a year for the past five years. Much of this was attributed to the rise of electricity costs. Consequently, the chamber was fighting attempts by the state-owned power utility Eskom for another above-inflation increase.

Currently around 80% of platinum operations were loss-making, with about half of gold producers in the same position. Even within the context of a global slowdown in mining, South Africa was performing badly, Baxter said. “Our low ranking internationally is also a reflection of political uncertainty,” he added.

ZWANE SPEAKS

Some of this disquiet follows the surprise appointment of Mosebenzi Zwane as mines minister last September. So unexpected was the move that the name of Zwane’s predecessor, Ngoako Ramatlhodi, was still on pre-Indaba literature as a headline speaker.

The axing of Ramatlhodi was not fully explained by his boss, South African President Jacob Zuma. However, published reports link the decision to a powerful business faction close to the president who wanted a more pliant minister in place, one willing to foster their own interests.

Zwana is viewed as a political lightweight, but is also within Zuma’s circle. For many in the local mining industry, Zwane’s appearance at the Indaba was the first time they had heard him speak in public.

During his address, the minister said he had spent his four months in office having “taken the time to understand the views of the industry.”

“After much reflection, I am convinced that during our summer season, as an industry, we have failed ourselves in not preparing better for this winter,” he said.

He said he was aware of industry concern around the finalization of legislation, in particular the Mineral and Petroleum Resources Development Amendment Act (MPRDA), which has been in the air for some time now. Mining companies fear that if passed as is, the law will give the minister wide powers to intervene in how they run their businesses.

At the same time, government would revisit the Mining Charter, legislation that mandates black ownership and participation at all levels of mining. Zwane touched on the concern of mining companies that constant tinkering with laws created an environment in which it was difficult to plan. “You indicated that political stability is necessary,” he said.

The government was making progress to ensure labor stability, and that events such as the crushing five-monthlong strike in the platinum sector would not be repeated. Zwane added that the ruling party also provided ongoing political stability.

“We continue to deliver a stable democratic state, with the fifth consecutive administration ushered in through another free and fair national election, in which the oldest liberation movement, the African National Congress, secured in excess of a 62% majority.”

Finally, Zwane read a list of mining companies that had made it through the year without any fatalities, a point that stood out for some observers who attended the briefing.

“In my view, it is quite rare for a minister to give a list of company names in a public address and I believe that it shows that he will be taking mine safety very, very seriously,” said Jacques Barradas, mining specialist at Grant Thornton Attorneys in Johannesburg.

Barradas said, too, that he was encouraged by the nod toward stable labor relations.

“Zwane reinforced some of the key messaging we heard at the 2015 Mining Indaba last year, which emphasized government’s positioning that the five months of strike action, which occurred during 2014 in the platinum sector, will never be allowed to happen again. This was the most promising message in today’s keynote address because it should help to give international investors’ confidence in the South African economy.”

AFRICA AND THE CURRENT COMMODITIES BUST

Mark Cutifani, CEO of Anglo American, has thrown himself into the role of straight-talking Aussie at the helm of one of South Africa’s iconic mining companies. In this he didn’t disappoint, or hold back during his address.

“At the start of 2013, the aggregated market cap of mining stocks in the FTSE all-share was $555 billion; on January 1 this year, that was down to $169 billion,” Cutifani said in his opening remarks at the Indaba. “Global mining stocks have lost $1.4 trillion of market value since 2011… more than the combined value of Apple, Exxon/Mobil and Google.”

He touched on the international factors weighing on commodities, such as the slowdown of China’s growth, and the general economic malaise across world markets. However, he stated that the mining industry itself was largely to blame for its current predicament.

Mining companies had raced to add production to meet what they thought would be ongoing growth in demand, while aiming to be “the last man standing” as competitors were driven out of business or bought out. “This strategy generally has a net negative effect,” Cutifani said.

The industry was fortunate in one respect, he noted: the physical nature of resources meant they were inherently limited. Miners were aware of the difficulties in finding resources, where they were and how to bring them to market. “We, therefore, have a pretty good idea of which ones will turn out to be the great mines of the next 100 years.”

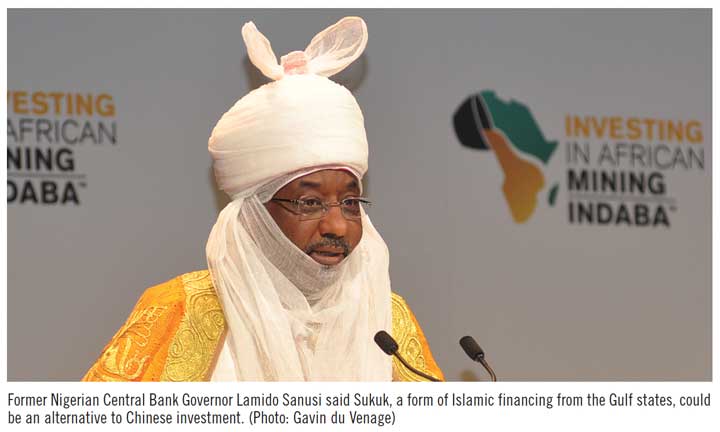

The Indaba was given an Africanist perspective by Lamido Sanusi, an investment banker who is also Nigerian royalty, holding the title of Emir of Kano. He is also a one-time Nigerian central bank governor, fired in 2013 for refusing to cover up a $20 billion hole in the country’s oil revenue fund, money that presumably disappeared into a murky network of corrupt officials.

Addressing the Indaba in his colorful robes of office, Sanusi said African countries had begun large spending programs to stimulate their economies, using resource revenue as a source of funding. “But as resource revenues declined, so did public sector wages and investment programs. A new model is needed.” Countries such as Nigeria and Angola, which both depended heavily on oil for their national budgets, were especially hard hit.

However, Africa as a whole continued to grow fast as its population passed 1 billion people, and its own demand for resources would contribute to the growth in mining. Around 30 mining projects would commence over the next decade, an investment of more than $18 billion, Sanusi said.

Funding now though would be difficult to find: “China now will struggle to finance African projects at the pace it has in the past.” Instead, he suggested seeking other sources of money, such as the Middle East, where financiers from the Gulf States were using Sukuk, or Islamic bonds, as a means to invest in other revenue streams to diversify away from oil dependency.

Ultimately, the Indaba is about deal making, and although the lawyers and bankers were mostly keeping their checkbooks in their pockets, there were emerging signs of opportunity. An intriguing development is that private equity (PE) firms—usually associated with Wall Street buyouts—were now looking at the struggling mining sector.

“PE firms prefer to get in at the bottom, and exit when the price is high,” said Richard Blunt, a partner at Baker & McKenzie, a London-based law firm.

“Usually, they look at a period of five to eight years—and we are now pretty much at the bottom of the cycle, so it’s a tempting opportunity to get in now.”

These firms were now stalking distressed assets and those being disposed of by overstretched mining houses, from juniors to the majors.

The price environment wasn’t the only factor driving private equity’s interest, said Morne van der Merwe, a partner in the Johannesburg office of Baker & McKenzie. In previous years, PE had been hesitant to enter mining because of a lack of the specialist skills needed by the projects. Now, the bloodletting across the industry meant even seasoned miners were in need of a new home and investment firms were happy to give them one.

“It might be something like a PE firm interested in a junior developing a project in Namibia; the company would seek to hire a geologist with experience of that particular ore body,” van der Merwe said. Managerial expertise from within the mining community would also be employed, to take command of new acquisitions.

Blunt added that PE firms would build management teams to handle the different aspects of an acquisition. For instance, one group would handle the initial evaluation of a project; another would take over running the mine, while another would take care of its disposal. Each team would move on to a new project when its phase was over.

EQUIPMENT AND TECHNOLOGY

As usual, the Indaba was a platform for technical companies to launch new products. This year, South Africa-based Master Drilling showed their concept 600-ton monster blind borer to sink shafts up to 2 km deep in one continuous process. This system is essentially a tunnel borer turned on its side.

“Conventional shaft sinking is a skills intensive process with up to 200 people on a crew,” Master Drilling CEO Danie Pretorius said. “These guys are getting thin on the ground.” Instead, fewer than 40 people would be needed for the as yet unnamed concept machine, vastly improving safety during shaft sinking.

“Conventional shaft sinking is a skills intensive process with up to 200 people on a crew,” Master Drilling CEO Danie Pretorius said. “These guys are getting thin on the ground.” Instead, fewer than 40 people would be needed for the as yet unnamed concept machine, vastly improving safety during shaft sinking.

It would also sink a shaft roughly twice as fast as conventional shaft sinking. A model drawn up by engineering consultants WorleyParsons on a case study gold mine showed the blind borer would sink a shaft in 18 months, instead of three years by conventional means.

The system would lay down concentric rings of concrete to stabilize the shaft as it descended, which meant that work could begin on opening up levels, even as sinking continued. The initial concept is for a 10-m-diameter shaft, bigger than most miners would like. Usually, narrower shafts are built to save money.

Pretorius pointed out that the cost saved in time would easily cover the extra tonnage removed. And, it could also open the way for delivering large machinery underground. One of the impediments to mechanization has always been the inability to get large equipment underground.

Pretorius added that the first working prototype would be ready by 2018. He expected it to cost around 800 million rand, or $50 million at current exchange rates.

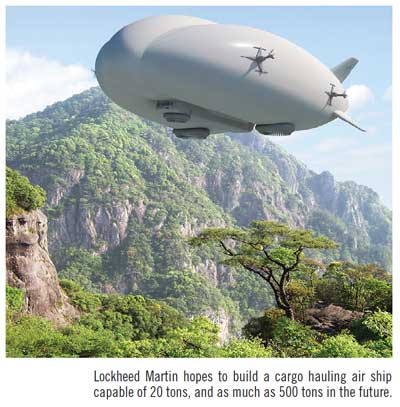

One of the quirkier products being touted at Indaba was undoubtedly U.S. defense contractor Lockheed Martin’s hybrid airship. The company, which builds hi-tech weapons systems, hopes to interest the mining industry in its proposal to haul men, equipment and ore around the African continent.

“It will land on water, sand, a field, even ice,” said Rob Binns, CEO of Hybrid Airships, while manning a booth in the Indaba’s display area. The prototype had already proven itself in Alaska, in the wildest of conditions.

“This is a dedicated cargo carrier, so it’s built with moving material and equipment in mind.” The first airship will be completed in 2018, and plans are under way for a 90-ton lift model, which would have similar lifting capacity to a cargo-configured Boeing 747. Eventually, a 500-ton lift model will be built, which would put it in the same category as a cargo ship.

Logistics has always been a major impediment to African mining, which must often build roads and even ports to move product. This airship won’t require more than a patch of dirt to land, Binns said.

“It will lower the logistics costs substantially, to the point where projects that are now under the radar because of cost, become viable,” Binns said. Miners though are a skeptical bunch and a few visitors visiting the stall seemed doubtful. However, Binns pointed out this scheme is being developed by the same company building the F-35 fighter, the world’s most advanced aircraft.

“Essentially Lockheed has taken the same technology they are putting into the F-35, and applied it to the problem of moving cargo around quickly and cheaply. The flight control system is basically straight out of the F-35, which will be used to plot course, navigate and fly.”

It will use helium for lift, but not entirely. The wing-shaped balloon will provide some lift during forward momentum supplied by four V6 diesel engines. Without movement it will sink gently to the ground. Best of all, said Binns, it will also allow transporters to avoid border posts and checkpoints, the bane of African truckers.

Although reception to the idea was one of bemusement, Binns said the Indaba had been worthwhile. “This is only our second mining event, but we’ve found it extremely useful to get our idea out there. We’ll definitely be back next year.”