Projected price increases for tin could revive project development

By Vladislav Vorotnikov

In the coming years, Russia could restore its tin mining industry and once again become one of the largest producers, according to plans recently filed by the largest mines and the authorities in the Far East regions of the country where most of the reserves are based. Russian reserves for tin metal total 2.17 million metric tons (mt), which is more than 1.5 times the known reserves in China, the world’s largest tin producer in 2013. Today, however, tin mining in Russia is almost nonexistent.

In the coming years, Russia could restore its tin mining industry and once again become one of the largest producers, according to plans recently filed by the largest mines and the authorities in the Far East regions of the country where most of the reserves are based. Russian reserves for tin metal total 2.17 million metric tons (mt), which is more than 1.5 times the known reserves in China, the world’s largest tin producer in 2013. Today, however, tin mining in Russia is almost nonexistent.

In 2012, Russian tin production increased by almost 17% year-on-year, to 384 mt. This was a turning point for the industry as it represented the first increase in many years. In 2013, the level of mining also rose by about 7% year-on-year to 411 mt from growing domestic demand and export supplies, which almost tripled during this period. It is expected that the volume of production in 2014 may reach 450 mt.

While this is good news for a country suffering huge financial headaches due to sanctions and steeply dipping oil prices, major increases in future production will hinge on developing deposits profitably and this will not be easily accomplished.

A MARKET CRISIS

A MARKET CRISIS

Among all the metals mined in Russia, tin production shows the worst development indicators over the past two decades. From 2005 to 2012, tin production fell to 384 mt from 4,110 mt (91%). A lack of investment starting in 2007 stalled the development of new mines until 2013.

The Russian tin mining industry collapsed because it was unprepared to operate in a free market economy, especially with low global prices. Using subsidies, the former Soviet Union maintained production volumes at 23,000 to 27,000 mt/y. The processing technology employed only recovered 50%-60% of the metal that was mined in rather difficult conditions. When the Soviet Union fell and the command-planned economy was abolished, almost all mines immediately became unprofitable and one after the other folded until 2009.

Ironically, the Russian Ministry of Industry and Trade estimates that starting in 2012, most of the closed tin mining operations could operate profitably even with outdated ore processing technology at today’s prices. In fact, a number of large mines, such as the Deputatsky Tin Mining Co., which went bankrupt and ceased operations in 2009, only needed to hold on for three or four years to see the general market improve.

More than global economics, the Russian tin mining industry suffered from weakening domestic demand. Over the past 20 years, domestic tin consumption dropped to 2,300 mt in 2012 from 19,000 mt in the beginning of the 1990s. Today, domestic production cannot meet domestic demand because of low production capacity and high production costs. Russian miners can’t compete with imported tin.

A nation that was once the largest tin producer with reserves of this metal, currently imports 80% of its domestic demand. In 2012, purchases of refined tin from abroad amounted to about 1,900 mt, which was 12% or 0.2 mt higher than in 2011. The main suppliers were Indonesia, Brazil and Malaysia.

In general, the grade for Russian tin ores is low compared to other regions. For example, the share of free-milling ores in Russian placer deposits is only about 12% of all proven reserves, while in Indonesia this figure is close to 100%. The average content of tin ores in the indigenous deposits is 0.28% (0.63 kg/m3 in placers), which is 2-2.5 times lower than in the foreign ores and placer deposits.

According to the Russian Ministry of Natural Reserves, only a third of the country’s deposits could be mined profitably. This figure could increase if prices continue to increase over the coming years. The general situation is also complicated by the fact that, since the mid-1990s, many of the tin miners were forced to high-grade their deposits.

While most of the world would be skeptical, a number of assets look very attractive. They face a common problem for the Russian mining industry, a lack of infrastructure. Almost all reserves are located in the area of North Siberia and Far East—sparsely populated parts of the country with poor transport systems and extreme weather conditions, which increases the cost of production.

There are other “structural problems,” which would hamper development plans. Due to the protracted crisis, the industry has lost access to mining engineers as well as miners. Lower salary levels have created an acute shortage of engineers compared to other aspects of the Russian mining industry.

REVIVAL OF THE INDUSTRY

The International Tin Research Institute (ITRI) forecasts that even despite the current temporary oversupply, the world’s market may face a tin deficit by the end of 2014. The world experienced tin shortages of 5,200 mt in 2011 and more than 10,000 mt in 2012.

Normally, Russian miners would need tin prices to reach a consistent level greater than $30,000/mt. With the recent shift in currency exchange rates between the Russian ruble and the dollar in 2014 (nearly 40%), this figure could be lowered to $27,000/mt. ITRI analysts forecast that by the end of 2014, the average global price for tin will be about $26,000/mt, and in the beginning of 2015 that price is likely to grow.

The Russian government also intends to promote the development of tin mining and has already granted significant tax breaks to all companies engaged in tin production, and promised the state support in many other forms.

The Russian Ministry of Finance released all tin mines in the Far East from the payment of a mineral extraction tax (MET) of 8% from 2011 to 2016. As a result, the profitability of all projects increased and the volume of production is growing again.

|

| Development activity for eventual production at a number of tin deposits in Russia has begun in recent years. |

The industry also started to receive the first investments. The investment group Russian Funds has allocated RUB 650 million ($20 million, based on the exchange rate in the beginning of 2014) in the development of Dal’olovo and Vostoko-lovo tin deposits. The total capacity of the two projects is 5,000 mt/y. Construction is already under way and it is expected that mining will be launched in 2018. Russian Funds believes the revival of the industry probably will start in the southern regions of the Far East, given their milder climate, availability of infrastructure and proximity to the sales markets.

Also, the Magadan Oblast has great potential in terms of tin mining with 66 primary deposits and total reserves of 52,000 mt and probable reserves of 279,000 mt. Some of these fields had already been developed before the bottom fell out of the market. Local representatives said that prior to a new mining launch, it is necessary to solve a number of serious problems, such as construction of roads and power lines. Resumption of mining in the Republic of Sakha (Yakutia), a large region with severe climate conditions, most likely will require more time, given the level of costs.

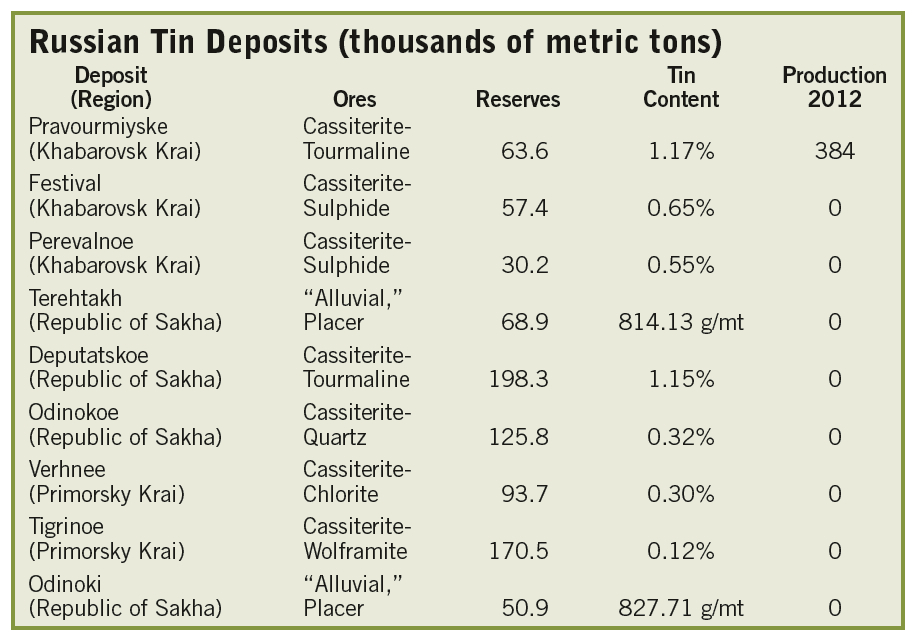

Most of tin deposits in Russia are large, 50,000-200,000 mt. There are a number of deposits with an average content of tin ores of 1% and more, including Deputatskoye, Sobolinoe, Churpunna and Tirehtyah.

COMPETITION FROM KAZAKHSTAN

If internal headwinds were not enough, the Implementation of the Industrial Development Program for Kazakhstan for 2010-2014 has made large investments in the development of a number of tin deposits. The projects received funding from the Eurasian Development Bank. The capacity of Kazakhstan’s tin industry should amount to 1.5 million mt of ore and 6,800 mt/y of tin by 2016.

The profitability of tin mining in Kazakhstan will be much higher than in Russia due to better infrastructure and a higher level of tin content in ores. Companies will also be able to extract rare earth materials, including tantalum and niobium, from the same deposits.

Given the fact that Russia, Kazakhstan and Belarus formed the Eurasia Economic Union on January 1, offering a common customs space, it is expected that the Kazakhstan mines may become serious competitors to the Russian projects, including the domestic Russian market.

According to official information, Russia exported 292 mt of tin in 2012—three times as much as it did in 2011. Almost all of the exports go to the countries of the Post Soviet Union block, including 70% of all export that has been directed to Kazakhstan.

|

| Restoration of facilities at Russia’s old, abandoned tin mines will require huge investments. |

|

| Russian companies are starting to conduct exploration in the south portion of the Far East region, where the climate is milder. |

LARGE PROJECTS

The volume of Russian tin production in coming years will grow due to a number of large-scale projects. The first and most important will be the development of Pyrkakay deposit in Chukotka. This is the largest tin deposit in Russia and one of the largest in the world, with total reserves of 228,000 mt of tin and 23,000 mt of tungsten. Millhouse, the owner of the deposit, is actively searching for ways to sell noncore assets.

Assuming it does not sell, Millhouse may launch the development of the deposit itself if the price for tin and tungsten will remain stable. Estimates of the cost to develop the deposit are $300 million, while start of production is scheduled for 2017. In the first year of production, the project is anticipated to yield 6 million mt of ore, 11,100 mt of tin and 814 mt of tungsten. The cost of development might be lower, as local authorities promise to provide state support to the project and take on the cost of the construction of necessary infrastructure.

Representatives from Millhouse conducted negotiations with several Asian companies to sell this asset in 2012. Both Yunnan Tin Group and Shenhua Group were rumored to be interested, but so far there isn’t any information that the negotiations brought any results. Yunnan Tin Group supposedly lost interest because the grade of ore was only 0.25%.

Several major tin-mining projects are slated for the Khabarovsk Krai region. Not all mines in this region went bankrupt and production continued. The main prospects are associated with the resumption of mining at Perevalnoye and Festival deposits. Regional Gov. Vyacheslav Shport has promised to provide all necessary state support to potential investors.

This region is also home to the Russian Tin Co., which so far is the largest producer with the annual level of mining at 282 mt. The company has invested $30 million in the development of tin mining in the region in the last few years. By 2018 the company plans to launch tin and copper production at several new mines, which will let it to boost the volume of tin production by nearly four times to 1,000 mt/y.

Development of the Sobolynoe deposit by the Trans-Baikal Mining Co. looks very promising. The company acquired the right to develop this asset at auction in December 2012 and currently is conducting exploration works on the property. The volume of tin production at the deposit could reach 3,500 to 5,000 mt, with an investment of $120 million. The company, however, has not officially confirmed these figures.

If all of these projects were launched, Russia could increase production to 20,000 mt/y by 2025. However, many of these plans may only be implemented if prices remain high and stable. Projects in remote regions, such as Republic of Sakha (Yakutia) need strong state support. Market players today do not believe that the government will really be able to guarantee this kind of support, given the serious challenges that are currently facing the Russian economy.

Vladislav Vorotnikov is E&MJ’s Moscow-based correspondent. He can be reached at vorotnikov.vlsl@gmail.com.