Engine suppliers are nearing the final stage of compliance with increasingly strict diesel emissions standards. One of their remaining challenges is to assure equipment OEMs and owners that new, cleaner-burning engines don’t come with a big bump in installation or ownership costs.

By Russell A. Carter, Managing Editor

|

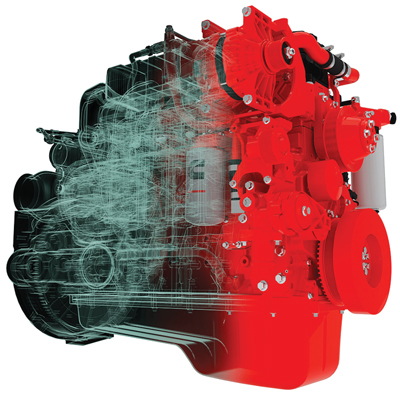

| Tier 4 Final architecture for Cummins’mid-range and heavy-duty engine range commonly used in mining includes Cooled Exhaust Gas Recirculation (Cooled EGR), plus Selective Catalytic Reduction (SCR). |

Diesel power is one of the core forces that drive mining progress, providing motive energy for countless site activities. For a technology that’s been around for nearly 125 years, it shows surprisingly few signs of age. Not that it hasn’t evolved and matured steadily during its century-plus history, but over the past two decades, constant pressure to satisfy increasingly stringent government-mandated emissions—such as the U.S. Environmental Protection Agency’s (EPA) Tier 1–4 and similar European Union Stage I–IV regulations—has resulted in a kind of facelift for this power platform, including the mid- to high-horsepower engine models used in mining, transforming them from the smoke-belching dinosaurs of the mid 20th century to responsible corporate citizens today.

This year marked a milestone in the diesel timeline as the Tier 4 Final emissions standards for off-highway engines rated at 174 to 751 hp (130–560 kW) became effective in January, sparking a steady stream of engine original equipment manufacturer (OEM) announcements of compliance with the new standards and setting the stage for a similar flurry of news in early 2015, when engines larger than 751 hp become subject to their own set of Tier 4 Final emissions standards.

Each of the leading diesel OEMs for mobile mining equipment—Caterpillar, Cummins, MTU, Komatsu, Volvo Penta, Liebherr and others—has its own proprietary approach for meeting the Tier 4 standards. They all involve variations of four principal factors that govern diesel ignition and exhaust: fuel, air, electronic controls and aftertreatment. In many cases, the move from Tier 4 Interim to Tier 4 Final emissions control levels has required the addition of exhaust aftertreatment, but not much else in the way of deviation from manufacturers’ proven Tier 4 Interim technology.

From the OEMs’ point of view, their emissions-control efforts have been highly effective: Cummins, for example, likes to point out that when Tier 4 Final controls are completely in effect, it would take 25 Tier 4 Final-compliant machines to produce the same level of emissions generated by just one equivalent Tier 1 machine.

It hasn’t been an easy task. Evelynn Sterling, technical director at Cummins Inc., told an audience at the 2013 World Mining Congress that, “…the 2014–2015 emissions regulations presented the most significant challenge to our customers’ diesel-powered equipment design and operation in recent history.”

In fact, said Sterling, during Cummins’ OEM and voice-of-the-customer surveys, operators told the company there were a number of engine design points that would be “nonnegotiable”:

- Power and performance must be maintained or improved.

- Total cost of ownership should be lower, with improved fuel efficiency.

- Maintenance and durability must be maintained or improved.

- Availability should be increased.

- Engine service should be made easier.

- Fewer turbochargers, not more.

“We also heard ‘no additional fluids!’ but SCR (Selective Catalytic Reduction) requires Diesel Exhaust Fluid (DEF),” added Sterling.

She pointed out that Cummins was able to draw from a deep pool of prior experience when it came to diesel engine performance, having produced 1 million exhaust gas recirculation (EGR)-equipped and 650,000 diesel particulate filter (DPF)-equipped engines and 350,000 SCR systems, along with 3 million Variable Geometry Turbochargers (VGTs). As a completely integrated engine builder—capable of designing and manufacturing a complete diesel power platform in-house—Cummins refined its emissions-control solution so that its Tier 4 Interim mid-range and heavy-duty engines were “predesigned” to meet the additional demands of Tier 4 Final standards without significant changes. It leveraged its over-the-road technology platforms to develop products that were validated for the off-road market.

The Tier 4 Final architecture for both its mid-range engines—which include the QSB 3.3, QSB 4.5, QSB 6.7 and QSL 9, offering power ratings from 75 to 400 hp—and its offroad heavy-duty engine range (QSX 11.9 and QSX15, with power ratings from 350 to 675 hp) include Cooled EGR, plus SCR. In the mid-range engine group, SCR employs the Cummins Compact Catalyst (CCC), while the larger engine group uses a Cummins particulate filter.

Citing, as an example, the performance specifications of Cummins’ QSB 6.7 engine after the Tier 4 Interim to Tier 4 Final transition, Sterling let the facts speak for themselves: “Same power output and performance, reduced fuel consumption and no change to engine installation.”

In addition, the Tier 4 Final QSB 6.7 brought no changes to engine oil drain intervals, or to fuel, oil and coolant filters. The Tier 4 Final version includes a no-maintenance design crankcase breather and a DEF pump filter that shouldn’t require replacement before about 3,000 hours of operation.

The “easy install, easy maintenance, no performance loss” is a recurrent theme shared by the major diesel builders, aimed at assuring equipment OEMs and operators that Tier 4 Final engines won’t pose unexpected usability problems.

Cummins called attention to its Tier 4 Final field-test program earlier this year, stating that the program had accumulated more than 140,000 hours with operators working in commercial service. The field-test program, initiated two years ago, includes nearly 70 different machines at sites selected specifically to cover challenging conditions.

Cummins noted that the field-test program went beyond typical wheel-loader and excavator endurance test cycles to cover a wide variety of specialized equipment, such as a rock drill working at a mine site in very dusty, abrasive conditions.

Initially focused on the QSB6.7, QSL9 and QSX15 6-cylinder engine range across the 174 hp to 675 hp (130-503 kW) power range, the field-test program then expanded to incorporate the new heavy-duty QSG12 and compact QSF2.8. The company said field-testing of its QSK high-horsepower engine range for mining is well advanced, including the QSK19 engine rated at 800 hp (597 kW).

|

| Cat Industrial, which sells the company’s engines to equipment OEMs, said it will offer a range of Tier 4 Final-compliant models, including the C7.1 ACERT engine shown here up to the much larger C27 and C32, beginning later this year. |

Cat Solves its Myriad Applications Puzzle

Caterpillar, which claims pole position as the largest vertically integrated manufacturer, had to find a way to deliver engine solutions that not only met increasingly stringent emissions standards but also the performance criteria of each specific customer. With an engine product line that ranges in power output from 4.1 kW (5.5 bhp) to more than 5,587 kW (7,500 bhp), that posed a unique challenge, according to the company. The number of specific customer applications using Cat engines today easily reaches into the thousands.

Cat said its Tier 4 Final technology choices provide the ability to reliably manage aftertreatment thermal needs, minimize product content changes, and in most cases, require only one supplemental system compared with Tier 4 Interim. Additionally, Caterpillar’s experience DPF technology and the decision to utilize it on many engine platforms positions Cat engine systems to meet future particle count standards should they be implemented.

By working closely with its customers to understand their business and equipment requirements, Cat said it determined that one technology solution does not fit all applications; its Tier 4 architecture—encompassing multiple combinations of electronics, fuel systems, air systems and aftertreatment components—based on engine size, application and geographic destination results in scalable, integrated systems that can be tailored to meet customer needs.

Mike Reinhart, Caterpillar’s Industrial regional marketing manager, explained that Cat determined that a DPF-based after-treatment solution provided maximum customer value at Tier 4 for its engines in the 130 kW (175 bhp) to 560 kW (750 bhp) range—generally offering better transient response, greater power density and reduced fuel and total fluid consumption. The DPF solution, according to the company, was proven at the Tier 4 Interim phase with more than 40 million operating hours recorded by customers on more than 80,000 engines powering Cat machines and OEM equipment.

For certain applications requiring engines rated 129 kW (173 bhp) and below, it developed select no-DPF systems. Elimination of the DPF on these engine platforms allows for easier, more flexible installations into limited spaces. Conversely, larger equipment in the 130 kW (175 bhp) to 560 kW (750 bhp) range provide more installation space and the capability to introduce modular after-treatment solutions.

Cat has developed a DPF to work with its Ventilation Reduction (VR) Package available on Cat LHD’s and underground mine trucks. VR Package engines have a lower level of diesel particulate matter (DPM) in their exhaust compared with EPA Tier 3 engines. Due to local mining regulations, the VR Package is not available in every region.

The Cat DPF uses flow-through filter technology and catalytic conversion to lower DPM to an even lower level than with the VR engine alone. The DPF is installed in place of the existing muffler/DOC package.

The filter medium is optimized to work with the VR Package engine hardware and software to deliver more than 50% DPM reduction in the exhaust. There is no increase of NOx compared with muffler/DOC system, and the system maintains engine back pressure within specifications. According to the company, the DPF will not plug with particulates and ash, and requires no additional service intervals for cleaning.

The Cat DPF is constructed with a sintered metal fleece and a corrugated mixing foil. The chemistry of the metal fleece was specifically developed to reduce PM output and to control NOx, as well as to enhance regeneration of the exhaust particulates. For correct DPF operation, Ultra Low Sulphur Diesel (ULSD) and low-ash engine oil (CJ-4) is required.

Komatsu Goes ‘Fluid Neutral’ with SCR

Komatsu announced in January the imminent start of production on its Tier 4 Final engines ranging in size from 3.3 to 46 liters. It said it had achieved compliance with Tier 4 final standards by employin an integrated combination of next-generation high-pressure common rail fuel injection (HPCR), high-efficiency EGR, VGT and DPF.

Komatsu also said it had introduced a newly designed, proprietary SCR device to provide high passive regeneration capability for its DPF with minimal impact on machine operation and production.

With the addition of the SCR system, a stringent design target of “fluid neutral” or better was established. In a “fluid neutral” situation, the volume of fuel burned plus the volume of AdBlue/DEF consumed is equal to or less than the total volume of fuel burned in the previous-generation machine. This achievement lowers operating costs for the customer as AdBlue/DEF typically costs less than diesel.

|

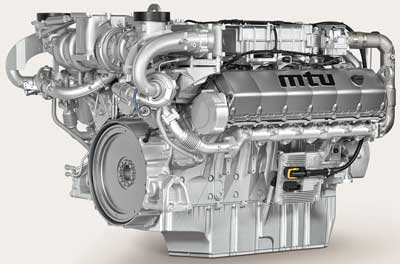

| MTU’s larger diesel models, commonly used to power haul trucks and excavators, won’t require exhaust aftertreatment to meet Tier 4 Final standards, according to the company. |

MTU’s Big Mining Diesels Avoid Aftertreatment

Earlier this year at the ConExpo trade show in Las Vegas, the MTU engine group of Rolls Royce Power Systems (formerly Tognum AG) displayed a selection of Tier 4-compliant engines, highlighting its Series 1500, an in-line 6-cylinder engine with SCR, designed for ease of installation by OEMs, according to the company.

The Series 1500 offers power ratings from 400 kW to 460 kW (536 bhp to 617 bhp). Also on display was the Series 1000, rated from 100 to 260 kW (134 to 349 bhp) with SCR; Series 1300, rated from 320 to 390 kW (429 to 523 bhp); and Series 1600, rated 567 up to 730 kW (760 up to 979 bhp).

The company noted that its Series 2000 and 4000 diesels, designed for heavy-duty mining applications, will be Tier 4 Final-compliant without the use of exhaust aftertreatment, a first for the mining and construction industries.

MTU also displayed the all-new MTU Power Drive Unit, used for providing mechanical power to equipment such as pumps, drills and many other types of industrial machines. The new Power Drive Unit uses MTU’s SCR-only Tier 4 final- compliant engine lineup, from the Series 1000 to the Series 1500. The MTU Power Drive Units will meet EPA Tier 4 emissions without need of DPFs or DOCs. MTU said it is developing this product family with a range of power ratings and adaptations as well as for additional emission performance.

|

| The high-pressure common rail fuel injection system shown in this X-ray view of a Liebherr diesel is an integral element in most engine suppliers’ Tier 4 Final technology. |

Liebherr Keeps it Simple

Liebherr said its Tier 4 Final-compliant diesel engines don’t require a DOC and offer excellent operating values, reasonable costs for exhaust gas aftertreatment and significantly reduced engine-system complexity—the result of its combination of sophisticated combustion engineering design, optimized DEF processing and integration of critical software functions in a new control unit.

In simplest terms, Liebherr will offer standardized basic engines that can be adapted to emissions requirements in different markets and regions through minor modifications or by fitting exhaust gas aftertreatment systems. Specifically, it explained, that means that its Tier 2, Tier 3 and Tier 4 engines have the same performance, the same cooling system parameters, and the same installation interfaces, enabling OEMs to substantially simplify their machine design requirements by allowing similar engines with different emission standards to be installed in the same basic machine.

As one of the few major engine builders providing Tier 4 Final-compliant engines without a DOC, Liebherr said its “SCR only” solution assures no damage to the aftertreatment system even if the machine is run on fuel with a higher sulphur content than recommended. This is particularly beneficial for equipment rental suppliers. Its Tier 4 Final engines also can be used in countries where sulphur-free fuel is not always available.

Volvo Penta Considers Cost of Ownership

Volvo Penta said it recognizes that total cost of engine ownership is a concern for OEMs and operators alike—which is why it focused on driving down operating costs for its Tier 4 Final engines, as Darren Tasker, director of industrial business in the Americas, explained.

When equipment OEMs choose new engines for their products, it’s not enough to just look at the initial cost of the engine: they also have to think of the total cost of ownership their customers will face over the engine’s lifecycle.

“For most operators, ‘total cost of ownership’ translates into ‘return on investment,’” said Tasker. “Total cost of ownership is how efficient an engine is to operate over its lifetime and what it will cost to run during that entire period.” Volvo Penta, said Tasker, calculates total cost of ownership as engine price + integration cost + cost of operation and service – resale value.

Because fuel costs account for up to 95% of lifetime ownership costs, boosting fuel efficiency can dramatically reduce TCO. Volvo Penta’s primary method of improving fuel efficiency is achieved by using SCR and EGR. As there’s no DOC or DPF, which require regular upkeep and replacement, Volvo Penta claims its after-treatment system is less costly to maintain and operate—and that it also greatly reduces ventilation costs for mining equipment. According to the company, replacing a less efficient engine with one of its Tier 4 Final engines can reduce ventilation needs by up to 30 m3 of air flow per hour.

It also pointed out that, unlike some competitors who deal with engine integration through their distribution channels, it has application engineers with integration expertise in each global region who are fully familiar with its products and who interface directly with large OEMs to identify efficient integration solutions.

“Anything we can save on installation costs, the OEM can translate into a lower purchase price for its customers,” Tasker said. “We’ve invested heavily in our application engineering resources, and we feel our approach is fairly unique in the industry.”

Meeting the Challenge of Equipment Migration

Because nonroad, mid- to high-horsepower diesel emissions are currently only tightly regulated in the U.S., Canada, Europe and Japan, with a few other countries such as Brazil and China trying to put similar controls in place, most of the remaining global market can still use “less-regulated” engines—prompting the OEMs, somewhat ironically, to devise techniques for partially unwinding carefully crafted emissions-control technologies to ensure continued operability when used higher-tier equipment is sold to customers in less-regulated regions.

“Tier 4 used equipment migration is a complex issue,” said Ramin Younessi, vice president, Caterpillar Industrial Power Systems Division. “Challenges arise due to diverse emissions regulations, the need for dealer readiness training and the need to help customers understand how to operate and maintain these next generation products. Most importantly, customers contemplating the purchase or modification of used Cat Tier 4 products need to understand and comply with their local regulatory requirements.”

Late last year, Cat announced its strategy for meeting the needs of customers selling and purchasing used Tier 4 Interim products for operation in lesser regulated countries, where prevailing fuel quality and fuel sulphur content vary widely. Based on extensive testing, analysis and field validation, Cat determined that its Tier 4 Interim engine systems between 156 kW and 895 kW (7-32-liter displacement engines) will not require modification to operate in lesser regulated countries. For Tier 4 Interim engines rated below 156 kW, Cat will offer authorized modification processes that remove aftertreatment from a machine, and commercial engine configurations to enable operation in lesser regulated countries. The modification processes, which includes decertification, became available this year to customers in lesser regulated countries through local Cat dealers.

Younessi added, “With the migration strategy, we’re looking forward, ahead of the Tier 4 Interim products that are already finding their way overseas to lesser regulated countries. Tier 4 Final products won’t be far behind the Interim products, which is why the strategy we’ve developed focuses on a solution for today’s customers—and for future customers.”

Beginning with Cat dealers in locations identified as higher probability recipients of used Tier 4 equipment, the company said it was preparing them to support the migration of used equipment to lesser regulated countries. These dealers will have access to service training, parts stock, service tooling and product information, including detailed information on specific product availability.

MTU, Volvo Penta, Scania and other builders also announced new high-sulphur fuel changeover strategies.

MTU’s Sulphur Tolerance Solution is now available for Tier 4 Interim MTU Series 900, 500 and 460 engines, and will be available for its complete lineup of Tier 4 Final certified Series 1000–1500 engines in the near future. The solution will enable OEMs to utilize the latest MTU engine technology in countries where ultra-low sulphur diesel (ULSD) fuel is not available, and will also protect MTU engines from harmful effects of high sulphur fuel.

Bernd Krueper, vice-president of global industrial sales, MTU Friedrichshafen, said, “This new capability will also simplify design, ordering, and installation processes for OEMs and repower customers around the world.”

Cummins will offer a Sulphur Tolerance Kit, allowing export of used Tier 4 Interim and Tier 4 Final equipment into regions where ULSD is not available. The kit, according to Cummins, is intended to provide options to operators and dealers who may ultimately sell Tier 4 powered equipment in the used market, offering flexibility in the regions into which they deliver the equipment. The Sulphur Tolerance Kit includes new engine calibrations and hardware.

Attacking total cost of ownership from yet another angle, Volvo Penta said it also tries to ensure its engines are attractive at the point of resale, offering residual value even after long use. One way of doing that is by allowing an engine to be “de-tiered.” This may include removing the aftertreatment system and making modifications to allow for higher sulphur fuel use so that the engine can be sold in non-regulated markets. This capability, according to the company, is now a feature of all of Volvo Penta’s Tier 4 Final products.