Although the concept of driverless haul trucks emerged in the 1970s, it took 30 years before the first systems took shape. E&MJ looks at the challenges and achievements.

By Simon Walker, European Editor

While the concept of driverless haul trucks has been mooted for decades, the reality has been more challenging to implement. Nonetheless, a small handful of mines have led the way, and the experience gained by these pioneers has helped to bring the concept at least part-way to maturity. With safety the most critical aspect, and safety-related incidents the most likely to receive withering criticism, it has been a gradual learning process for the mines and machine manufacturers involved. That the technology has been implemented with, on the whole, a good safety record, is a testament both to its strength and to the dedication of the people who have made it work satisfactorily.

No one will dispute that there have been huge challenges along the haul road. Running a mine with autonomous trucks is not just a matter of taking the driver from the cab and putting him or her into a control center. If it is already working, the operation has to be redesigned, not only to take the concept into account, but also to make sure that it provides the intended benefits—so it is easy to see that the introduction of autonomous haulage is actually simpler when integral to the design of a new mine. Little surprise then, that although initial trials were undertaken in stand-alone sections of existing mines, most of today’s operating systems can be found where mining companies have grabbed the opportunity for installation in new pits.

So, what are the main drivers behind the introduction of autonomous haulage in surface mines? Safety is one, since automated systems are less likely to experience unpredictable mistakes than their manually driven counterparts. In a presentation on automated haul trucks, Professor John Meech of the University of British Columbia pointed out that worldwide, typically two or three truck operators die each year because of incidents resulting from human error.

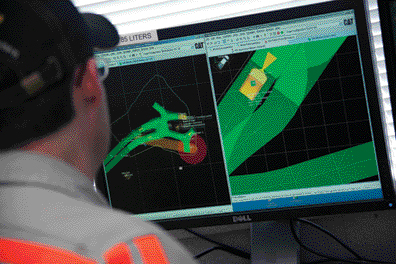

|

| Control-center staff have second-by-second information on each truck’s position. (Photo courtesy of Caterpillar) |

Economy is certainly another, since the cost of employing a team of drivers to run a haul truck round the clock is substantial. Add to that the raw fact that, driving a big haul truck for a 10- or 12-hour shift on a regular load-haul-dump-return cycle is essentially a tedious task. Since tedium quickly leads to boredom, the potential for inattention increases proportionately, and hence the risk of mistakes being made.

There is also the issue of job dissatisfaction, with mines in remote locations—such as the Pilbara in Western Australia—experiencing high operator turnover simply because of the working and living conditions. Shortages of skilled operators are also becoming more commonplace, with truck drivers and maintenance personnel being high up the list of those trades affected. Yet another reason, then, for mines in remote locations to look seriously at reducing their dependence on staff who may be hard to source, harder to retain, and expensive to employ.

The Key Players

Thus far, the introduction of autonomous haul trucks has been targeted for a few specific operations, with the focus predominantly on mines producing iron ore and copper. Working with Komatsu, Codelco led the way, firstly with a trial at its Radimiro Tomic copper mine in northern Chile, then with the introduction of autonomous trucks at Gabriela Mistral (Gaby), which was commissioned in 2008 as the world’s first surface mine to rely completely on this technology.

Komatsu has also been heavily involved with the introduction of autonomous trucks as part of Rio Tinto’s Mine of the Future program, which has grown steadily since the first units began running at West Angelas in 2008. Subsequent extensions to the scheme have brought machines into operation at Yandi and, most recently, at Hope Downs 4, with Rio Tinto aiming to have a 150 strong fleet running at its Pilbara iron-ore operations by 2015.

Not surprisingly, given that they face the same challenges, the other Pilbara operators have followed suit, albeit by favoring Caterpillar’s approach to autonomous haulage. Having run an initial trial at its Navajo coal mine in the U.S., BHP Billiton is now building its autonomous truck fleet at Jimblebar, while Caterpillar is working with Fortescue to introduce the technology at its Solomon hub. Remember that Fortescue has already shown its innovative streak with the use of surface miners in its iron-ore operations, so the investment in autonomous haulage appears logical.

The most recent entrant to this challenging market, Hitachi, began work in April at the Meandu coal mine in Queensland. Here, the company is carrying out a three-truck trial, albeit independently from the mine owner, Stanwell Corp., over the next three years to prove its version of the technology in an operating environment.

Developments Over Time

One of the key areas from which autonomous truck haulage has grown has been the concept of automated dispatching. From its early days in the 1980s, companies such as Modular Mining Systems and Wenco International have continuously developed their systems, with a plethora of installations worldwide assisting surface mines to optimize their haulage fleet movements. Recognizing the value of these systems to autonomous haulage, Komatsu was quick off the mark with its acquisition of a holding in Modular in 1996, increasing this to full ownership in 2003.

In a press release issued to coincide with Komatsu’s ground-breaking agreement with Rio Tinto in 2011, Modular explained that its contribution to the Komatsu autonomous haulage system includes the supervisory system, operational intelligence, communications infrastructure, operational reporting and vehicle-interaction safety technologies. “Autonomous haulage is the logical and important next step toward increasing productivity and safety, reducing maintenance costs and environmental impacts, and creating high-tech jobs in the mining industry,” the company added.

Hitachi’s subsequent acquisition of a holding in Wenco in mid-2009 merely confirmed what industry watchers had already ascertained: that sophisticated fleet management systems are an essential foundation for the development of autonomous haulage systems (AHS). Hitachi confirmed as much in its announcement last April of the Meandu trial. “The objective is to deliver optimized AHS solutions to customers,” the company said, “based on the proven Hitachi AC-drive dump truck system in collaboration with the latest products from Wenco International Mining Systems Ltd.”

As Meech noted, some fundamental questions that any reliable autonomous haulage system has to answer include localization, navigation, obstacle avoidance and machine health. To these aspects such as production and maintenance scheduling can be added, so all-in-all, a competent system amounts to much more than merely monitoring machine movements by GPS.

|

| Komatsu’s 930E-4AT autonomous haul truck. |

Komatsu’s Early Days…

In an edition of its customer magazine, Views, published in 2010, Komatsu’s general manager for autonomous haulage systems, Takao Nagai, explained that the company had been investigating the possibility of this type of system since the 1970s, with the first major trial undertaken at an Australian coal mine in 1995. “At that time, our system was only able to manage no more than four driverless dump trucks,” he said. To increase the number of units in control, we needed to develop a fleet management system, but we had almost no experience of developing such software at Komatsu.”

The solution came with Komatsu’s tie-up with Modular Mining Systems (MMS) in 1996, with Nagai noting that “since then, MMS has played an increasingly important role in the commercialization of AHS.”

“In 2002, we got the official ‘go’ in the company for our development plan for AHS, and kicked off its development for use in large mines,” Nagai said. “After developing and testing the system for about three years, in December 2005 we began testing a fleet of five 930E-AT driverless dump trucks at Codelco’s Radomiro Tomic mine.

“In January 2008, we formally delivered 11 driverless dump trucks to Codelco’s Gaby copper mine, marking the world’s first commercialization of AHS. Under stable operation, 11 units transported 48.5 million metric tons (mt) of material, including 24.5 million mt of ore, and contributed to the production of 148,000 mt of copper for the 2008/09 fiscal year.” A further truck was added to the fleet the following year, since then, the number of trucks has risen to 17.

Looking at some of the challenges involved in making autonomous truck haulage as efficient as possible, Nagai said, “One of the demanding tasks of future development concerns how closely we can get our AHS up to human levels of intelligence and skills. Veteran drivers can get the best possible performance out of dump trucks with their superior driving skills, whereas we need to make a number of limitations on driverless dump trucks, such as speed, mainly to ensure sufficient safety. While driverless dump trucks offer significant advantages over man-driven trucks, such as the precision of machinery, we are taking up the challenge of developing a system that can compete with human levels of intelligence and skills and making the fullest use of existing advantages.”

In the 2010 Views report, Peter Carter, Modular’s then president and CEO, added “We are now moving toward the most challenging aspect of our work, that is, developing software that is intelligent enough to enable our driverless trucks to understand how to interact with the other heavy earthmoving equipment, such as hydraulic excavators, bulldozers, motor graders and water trucks, while operating in the normal production cycle. If they can respond flexibly to different situations, which will eliminate accidents and other risks, they should be able to offer performance very close to that of their operator-driven counterparts. It’s a challenging task, but I feel very confident that we can make it,” he said.

|

| Caterpillar’s Command for hauling system controls the entire truck cycle from load to dump and back. |

…and Caterpillar’s

According to Caterpillar, the first public display of its autonomous truck technology took place at MINExpo 1996, where a video screen on the company’s stand showed two autonomous off-highway trucks working at a quarry in Texas. The quarry trial was intended to demonstrate the concept, and at the same time, visitors to Caterpillar’s Tinaja Hills demonstration center in Arizona saw a 777C autonomous truck demonstrate its capabilities. The company also used the show to announce its intention to develop further autonomous machines.

The next major stage came in 2010, when Caterpillar had four 793 autonomous trucks working as a fleet at its Arizona proving grounds. The following year, three of these trucks were sent for a full-scale trial at BHP Billiton’s Navajo coal mine.

Last March, Caterpillar reported that it had completed a 21-month trial of its Command for hauling autonomous truck system there, during which time the three trucks had moved nearly 2.3 million m3 of material. In addition, the company said, it had been able to refine its processes and procedures to build toward the commercial installation of larger fleets, with its team having gathered information that led to significant improvements in cycle times and truck utilization over the course of the trial.

During the trial, two 227-mt-capacity 793F trucks, and one 218 mt-capacity 793D, operated autonomously as they worked with a Cat 994F super high-lift wheel loader, staffed by a trained operator, moving overburden in a reclamation project.

“The extended trial in New Mexico enabled us to work within an operating mine to conduct training and implement safe work procedures—and to establish autono-

mous haulage processes that worked for the mine,” said Dan Hellige, Caterpillar’s mining solutions manager. “Because the trucks were often operating 24/7, we were able to make technical changes and see results quickly. That data guided us in making a number of improvements.”

Caterpillar reported that its team made two significant software updates and several minor updates as the feature set evolved. Improved travel-path planning and increased top speeds produced a significant reduction in cycle times, the company added, while refinements in the system and mine procedures also improved truck utilization by about 20% during the trial.

Operating Concepts

Caterpillar told E&MJ that in order to guide trucks safely and productively without a driver in the cab, it has brought together a number of specialized building blocks within its MineStar suite of systems and technologies.

GPS/GNSS provides the position location information for the trucks, and all possible haul routes are plotted with satellite data. Algorithms determine the optimum route for each truck, with the mine map being continuously updated in real time. For example, when dumping on the ground, the system tells the truck where to position itself, taking into consideration the last load dumped.

The loader or shovel operator signals the truck that it is full via a keypad in the loader cab, and the system tells the truck to drive away. Each truck has an onboard object-detection system that enables it to maneuver around any obstacles, and can stop the truck if necessary. The loader operator then spots the next empty truck and signals the system that the truck should back up under his bucket.

A system that Caterpillar calls Proximity Awareness sends a constant stream of data about each truck’s location and speed, and the availability of the loader, thus preventing traffic jams and associated delays.

The human controller, working inside a building on the perimeter of the site, can instruct a truck or the whole fleet to stop in case of an emergency. In addition, the controller can intervene to bring trucks in for scheduled maintenance and refueling, but otherwise, the trucks steer themselves and select the appropriate speeds based on sensor data and the traffic around them.

Komatsu describes its autonomous haulage system as involving information and communication technologies such as high precision RTK-GPS and dead reckoning technology for its navigation system, an obstacle-detection system, a wireless communication network and a fleet-management system to control the trucks. Information about the haul route and speed is sent wirelessly from the fleet-management system to the trucks on the move, as they ascertain their position by using GPS information.

For loading, the fleet-management system guides the trucks to the loading site, based on the position of the bucket of the GPS-fitted, man-operated hydraulic excavator or wheel loader. After loading, the system directs the trucks with to the dump site for unloading.

Using GPS and the wireless network, the fleet-management system controls all equipment in the mines, including other equipment and vehicles that are man-operated, to prevent collisions—if the obstacle-detection sensors detect another vehicle or person inside the haulage area during autonomous operation, the trucks stop immediately.

GPS is one of the key technologies on which Komatsu’s autonomous haulage system relies to locate the exact position of the trucks and to control them on their predetermined course. According to the Japanese manufacturer of surveying equipment, Topcon, there are several cutting-edge technologies, including high-precision GPS navigation systems, milliwave radar and optic-fiber gyro that could potentially accomplish the unmanned truck system. However, it claims to be the only Japanese manufacturer of high-precision GPS receivers. “We are proud to provide our GPS technology, one of our core competencies, to Komatsu and will continue to support their efforts to improve the safe and efficient operation of autonomous dump trucks,” said Satoshi Hirano, the company’s managing executive officer.

Current Projects

In April 2013, Rio Tinto announced that the autonomous truck systems at its Pilbara iron-ore mines had reached the significant milestone of moving a cumulative 100 million mt of rock. The total included material at West Angelas, where the technology was first trialed, at Yandicoogina, which then had a 13-strong autonomous truck fleet, and at Nammuldi, where six trucks had begun working the month before and had already moved more than 2 million mt. The company is also commissioning a further 19 Komatsu 830E-AT trucks at Hope Downs 4 during 2013/2014.

The West Angelas trial began in 2008 and involved five Komatsu 930E haulers. Having used the trucks initially on waste, in July 2012 Rio Tinto commissioned 10 autonomous haulers at the Junction South East (JSE) pit at Yandi, marking the first time they had been used for moving high-grade ore as well as low-grade and waste.

Speaking at the official opening Sam Walsh, then head of Rio Tinto’s iron-ore operations and now the company’s CEO said, “The deployment of these trucks at Yandocoogina is the next step in our program to introduce more than 150 driverless trucks to our Pilbara operations, making us the world’s largest owner and operator of these vehicles. They will be a critical part of our drive to outstanding safety and production efficiency.”

Meanwhile, Caterpillar told E&MJ that the continued evolution of its MineStar system and the successful trial of Command for hauling in New Mexico has driven a larger project with BHP Billiton—the launch of a fleet of 12 793F autono-

mous trucks at the company’s Jimblebar iron-ore mine, also in the Pilbara. “The Jimblebar installation offers the opportunity to more fully integrate autonomy with the mining operation and, in turn, to maximize the value that autonomy can deliver,” said mining solutions manager Dan Hellige. “Optimizing mining operations requires a systems approach.”

The introduction of the trucks at Jimblebar followed Caterpillar’s agreement in 2012 with the third major player in the Pilbara, Fortescue Metals Group, to supply a complete MineStar system for Fortescue’s Solomon project. An initial fleet of six 793F trucks is being built up to 45 by the end of 2015.

At the time, Caterpillar noted that the Solomon project will be the first to use all of its MineStar system surface-mining capability sets, and will manage both manned and autonomous machines. Fortescue’s CEO Nev Power added: “Autonomous haulage provides a highly efficient, productive and safe environment where it complements manned operations,” he said. “It also provides new opportunities for people with different skill sets and enhances safety through collision-avoidance technology and through reduced interaction between heavy equipment and people in mining areas.”

Across at Meandu in Queensland, Hitachi’s first foray into autonomous truck systems began last April with the start of the three-year trial using three EH5000-AC3 trucks. As well as GPS, the trucks also have a control system that allows precise speed control, helping them to negotiate steep slopes at the mine safely.

Hitachi’s general manager of mining in Australia, Eric Green, said the trial will develop automated mining trucks that can interact with other people-operated mining equipment. He also stressed that Hitachi has a long way to go to develop the technology, which is at a very early stage. “We want to do it right, and this will take very careful testing over a considerable time,” he said.

The Benefits

E&MJ asked both Caterpillar and Komatsu for their views on the benefits that can be achieved from using autonomous truck haulage. Caterpillar noted that the driving force for autonomous mining vehicle development was (and still is) safety and productivity. Removing humans from the work site reduces the opportunity for injury and negative health effects.

The company added that removing the operator from the machine eliminates machine downtime for changing operators, and food and rest breaks. Autonomous vehicles also eliminate human operator variability. The result most often seen is improved machine reliability and durability, better fuel efficiency and increased production rates over time, Caterpillar stated.

From Komatsu’s perspective, autonomous trucks offer three major advantages. Firstly, there is better safety though the elimination of incidents caused by drowsy, careless or unskilled truck drivers. Secondly, mines can achieve higher efficiency through having a planned and stable operation, with reduced variability caused by drivers’ breaks, shift change and fly-in/out days. The operation becomes accurate, repeatable, and predictable, with higher utilization and lower operational costs since there are no direct or indirect driver costs.

Lastly, Komatsu pointed out, there is a big advantage from an environmental perspective. Not only are carbon emissions cut because of decreased fuel consumption, but tire-disposal costs are lower since tires last longer. In general, and from a theoretical point of view, the company told E&MJ, autonomous haulage trucks use less fuel since maneuvering is system-controlled and avoids deviations that can result from driver choice.

Putting figures on these benefits is obviously mine-specific, although Meech has estimated some in generic terms through modeling mine operations. His view is that autonomous truck haulage can generate production and productivity improvements of 15%–20%, while cutting fuel consumption by 10%–15%. Tire wear rates can also be 5%–15% lower, while overall utilization of the vehicles can be 10%–20% higher. And, with better driving practice, maintenance costs can also fall, maybe by around 8%, Meech believes.

Against that, of course, is that individual trucks do cost more when equipped with the systems needed for autonomous operation. However, the higher initial capital cost can quickly be paid off through savings made on reduced bills for wages and on-costs such as fly in-fly out and minesite accommodation. With mines being operated in increasingly remote parts of the world, and with some regions critically short of experienced personnel, that is no small consideration.

Autonomous haulage is not the best choice for every surface mine. That only a few mining companies have chosen to adopt the technology speaks volumes for the complexity involved. Nonetheless, competitive pressures of all sorts will undoubtedly spur others on to join the club as the benefits become more readily apparent.