Should the mining industry reconsider a historic brownfield area with a grand environmentally responsible mining plan?

By William B. Wray1

The headframe for the Original mine towers over uptown Butte, Montana. (Photographer: Kevin Bone)

The Butte mining district in southwest Montana, USA, is unique among world-class polymetallic mineral deposits in the combination of its historical importance as “the Richest Hill on Earth,” the huge quantity and variety of previously mined metals, the size and significance of the city of Butte, the intricate 3-D pattern of veins from which the bulk of the metals has been produced to date, and the immense size of the remaining multimetal resource.

The Butte district contains one of the largest concentrations of copper, molybdenum, zinc, lead, silver, manganese and other metals on the planet. Through at least 1967 (The Anaconda Co., 1968), Butte had the largest cumulative metals production of any non-ferrous mining district in the world. However, mining gradually phased out through the 1970s and early 1980s.

Montana Resources LLP, as the heir and successor to much of the Butte mineral and mining assets, presently is the only company conducting mining operations in the district.

The Butte district presents an unequaled opportunity for the application of newly developed mining technology by a consortium of all interested stakeholders to recover the value of the large remaining mineral resource for the benefit of all parties. Could the Butte district be rejuvenated?

Developing a brownfield area rather than permitting new mines in environmentally sensitive areas could satisfy domestic demand for minerals and environmentalists who see the merit of modern environmentally responsible mining.

THE BUTTE RESOURCE: ITS HISTORY AND PRODUCTION

The Butte district is unique in the world in its combination of prolific metal-bearing veins and several centers of porphyry-style Cu-Mo mineralization. The deep-level emplacement of the porphyry deposits beginning about 62 million years ago was interrupted part way through to completion by formation of regional “east-west”-striking, “brittle-rock” nearer-surface fissures, and within and near the center of the district a conjugate set of “northwest” striking fissures (Houston and Dilles, 2013). These fissures penetrated deep into the then nearer-surface active porphyry mineralization zones, effectively terminating that mineralization event and permitting ore-depositing fluids to circulate laterally and vertically far beyond the limits of porphyry mineralization. The resulting ore veins have traditionally been called Main Stage mineralization, and the porphyry mineralization “pre-Main Stage.”

The Butte district has been mined for 150 years, first as a mediocre placer gold camp, then in a small way for near-surface, oxidized silver ore, and since 1880 primarily for copper. Once the many veins in the central part of the camp were recognized as being high in copper content, underground mining of the rich orebodies quickly ramped up, and by 1887 Butte had supplanted the Michigan Copper Belt as the world’s leading copper producing district (Stevens, 1902). Butte copper production continued to increase, and by 1892, Butte produced 47% of all the copper mined in the U.S. (id.).

During the early years of the district, the large vein zinc resources were noted, but for the most part not exploited. From 1905 until 1967, much high-grade as well as lower-grade vein zinc ore was mined. As of 1952, Anaconda’s electrolytic zinc refinery plant in Great Falls and its sister plant in Anaconda had the largest combined production capacity in the world, and produced 25% of the nation’s refined zinc (Linforth, 1952).

The Butte district was the leading U. S. producer of manganese ore between years 1917 and 1954. As of 1953, the Butte district contained the largest known deposits of manganese carbonate ore in the world (Linforth, 1953).

Silver was always recovered as a consistent byproduct of the copper and zinc ores, and in addition was mined as the principal metal from certain large “east-west” veins, mostly in the westerly and northerly regions of the district. As of 1953, the Butte district had produced 578 million oz of silver, said at the time to represent more cumulative silver production than any other district in the world (Linforth, 1953).

After World War II, in addition to selective vein mining, copper was recovered underground by bulk mining methods, principally block caving in the “horsetail” mineralized zones, and beginning in 1955 by surface mining of supergene chalcocite mineralization overprinted on Main Stage primary vein mineralization, from the Berkeley pit.

As a consequence of many factors, copper mining at Butte declined in importance in the 1970s. The last of the many underground operating mines closed in 1975, and mining in the Berkeley Pit was suspended in 1982. Then-owner ARCO subsequently sold much of its mineral interests, the Weed concentrator, and other mining assets to a subsidiary of Washington Construction Co. of Missoula, Montana. Montana Resources LLP in 1986 began mining the low-grade disseminated copper-molybdenum ore in the Continental pit near the east edge of the district. Montana Resources processes its ore in the Weed [Butte] concentrator, presently at a throughput rate of about 55,000 tons per day (Montana Resources, 2013; S. Czehura, pers. comm. 2013).

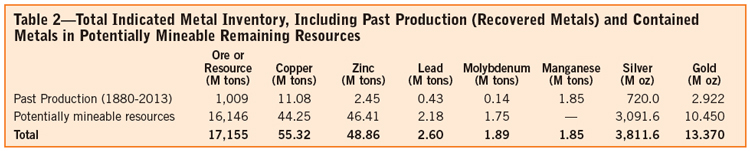

From 1880 through 2013, Butte produced (recovered from its ores) more than 22 billion lb of refined copper, 4.9 billion lb of refined zinc, 854 million lb of refined lead, 720 million oz of refined silver, 2.9 million oz of refined gold, 3.7 billion lb of manganese, and 271 million lb of molybdenum (Czehura, 2006; Montana Resources, 2012, and the author’s estimated district production for 2012 and 2013). The gross value of all Butte’s historic production, at today’s metals prices,2 would be more than $101.6 billion, of which more than 68% would be copper and 15% would be silver.

REMAINING BUTTE MINERAL RESOURCES

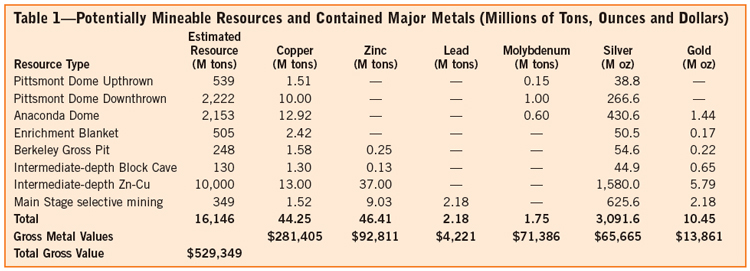

The Butte district, even after 150 years of mining, has huge remaining mineral resources, of a variety of types, all of which may now or in the future be amenable to profitable extraction. Montana Resources presently is exploiting only one of the various types of resources. Table 1 provides estimates of contained metals in each resource category.

Pittsmont Dome Upthrown Block resource—This is a low-grade Cu-Mo deposit situated within and beneath the present Montana Resources mining operation. The resource is in the upthrown block of the east flank of the pre-Main Stage Cu-Mo Pittsmont Dome, bounded on the west by the steeply west-dipping, post-mineral, north-striking Continental Fault. As of the end of 2013, proven and probable ore reserves are about 539 million tons averaging 0.28 % Cu, 0.027% Mo and 0.072 oz/ton Ag, at a 0.23% Cu-equivalent cutoff (Montana Resources, 2012, adjusted by the author to the end of 2013 without allowance for any recent reserve addition; Czehura, 2006). The author has no information on the amount of gold in this resource.

Pittsmont Dome Downthrown Block resource—This is the major portion of the Pittsmont Dome, the easterly of two nearly adjoining deep, pre-Main Stage deposits, the other being the Anaconda Dome (see below). The Cu-Mo zone in the downthrown block is in the shape of a flattened, moderately tilted dome, apexing about 2,500 ft. below the present surface. The calculated “geological reserve” of this resource is more than 2.22 billion tons averaging 0.45% Cu, 0.045% Mo, and 0.12 oz/ton Ag (Czehura, 2006), and is open on three sides down the flanks of the dome, and in part vertically. The average gold content of this resource is not known to the author.

Anaconda Dome resource—The Anaconda Dome, like the Pittsmont Dome, is in the shape of a flattened, slightly tilted dome, dipping gently to moderately downward in all directions from an apex beneath the west side flank of the Berkeley pit. The top of the dome, as marked by 0.45% Cu-0.01% Mo grade contours, is about 720 ft beneath the Berkeley pit bottom (Reed et al., 2013). The calculated “geological reserve” of this resource is more than 2.15 billion tons averaging 0.60% Cu, 0.028% Mo, and 0.20 oz/ton Ag (Czehura, 2006), plus zinc and gold, at 0.40% Cu cut-off (Miller, 1975), and is open on all four sides down the flanks of the dome, and in part vertically. The author estimated an average 0.00067 oz/ton Au. No estimate is given here for the zinc content.

Enrichment Blanket resource—A thick, but irregular and partly discontinuous zone or blanket of supergene chalcocite mineralization, beneath a leached capping and roughly conformable to topography, extends from the east side of the Berkeley pit, under the broad, alluvium-covered area east and southeast of Anaconda Hill to the Continental Fault. The identified enrichment blanket resource contains a calculated “geological reserve” of 505 million tons averaging 0.48% Cu and 0.10 oz/ton Ag (Czehura, 2006; Perry, 1974). The author estimates an average 0.00033 oz/ton Au.

Berkeley gross pit mineral inventory resource (deep [“Gross”] plan, approximate pit bottom—Kelley 2000 level)—Based upon Anaconda reserve determinations made prior to 1982, the author estimated that at pit closure the remaining mineral inventory (“ore”) within the projected deep pit outline was about 248 million tons averaging 0.70% Cu and 0.22 oz/ton Ag, at 0.40% Cu cutoff. The author estimated an average 0.00089 oz/ton Au and 0.10% Zn.

Intermediate-depth “Kelley Blocks” block cave resource—Beneath the Berkeley pit, and vertically situated between the near-surface supergene/overprint enrichment blanket and the deep Anaconda Dome, is a Main Stage copper resource in block-caving configuration. This resource, situated between the Kelley 2000 and 4200 levels, was defined while the underground mines were active, and originally was contemplated to be mined by block-caving with ore to be extracted through the main Kelley shaft. The resource consists mostly of closely spaced veins and “horsetail zone” copper veinlet mineralization. As defined, the resource includes 130 million tons averaging slightly more than 1% Cu, 0.345 oz/ton Ag, and 0.005 oz/ton Au (Czehura, 2006). The author assumed an average zinc content of 0.10 % Zn.

Intermediate-depth zinc-copper resource—Below the remaining enrichment blanket resource, adjoining the “Kelley Blocks” resource and the Berkeley pit remaining mineral inventory (“ore”), and above/peripheral to the tops of the Pittsmont and Anaconda domes, is a huge tonnage of low-grade mineralized rock, consisting of a pre-Main Stage halo of sulfide zinc and zinc-copper mineralization around and above the deeper-level two grade-delimited Cu-Mo Domes, upon which are overprinted later Main Stage Cu-Zn-Ag vein/veinlet-controlled mineralization. This tonnage also includes an unquantified amount of supergene, secondary sphalerite/wurtzite, which formed in part beneath the supergene copper enrichment blanket.

Although much of the Main Stage vein mineralization within this large volume of rock has been mined, a significant portion remains.

The author on the basis of historical limited assaying for copper, zinc and silver has estimated for speculation purposes a resource (tonnage rounded down) of 10 billion tons at an average grade of 0.37% Zn, 0.13% Cu and 0.158 oz/ton Ag. Assuming a Ag/Au ratio of 273, equal to the average recovered silver to gold ratio in the Butte Zn-rich Main Stage ores (Perry, 1974), this resource would also contain 0.000579 oz/st Au. The average lead content of this resource is not known.

Main Stage veins suitable for selective mining, exclusive of veins within bulk-mining resources. Many segments as well as entire lengths of Main Stage veins remain to be mined, despite 100-plus years of continuous underground mining activity, from before 1875 through 1975 (e.g. Perry, 1974). There is no comprehensive mineralization inventory of such veins and vein segments, although Anaconda kept detailed underground mine records, which would be available for future mine planning. A perhaps surprisingly large volume of the total district, including areas prospective for all metals, was never prospected or only scantily explored, for a great variety of reasons. The Butte underground vein system in no way can be said to be “mined-out.”

As compiled and estimated by the author, the total of 65.49 million tons of Anaconda “reserves” averaging overall 0.92% Cu, 5.23% Zn, 1.19% Pb, 2.97 oz/ton Ag, and 0.0114 oz/ton Au represents but a small fraction of the total remaining vein material that might be mineable.

The total tonnages of potentially mineable resources and contained major metals at Butte are a prize worth pursuing.

Combining the record of past production (recovered metals) with the potentially mineable metals (as contained metals), as shown in Table 2, further indicates the importance of the Butte district as one of the world’s largest repositories of non-ferrous metals, and possibly North America’s greatest polymetallic mineral district.

Of particular interest is the indication that Butte, perhaps uniquely, is a major “porphyry copper-zinc deposit,” containing (as estimated) very large and almost equal quantities (if not values) of copper and zinc.

FUNDAMENTAL CONSTRAINTS ON FUTURE MINING AT BUTTE

Butte represents a unique opportunity to completely rethink the possibilities for extracting the immense quantities of metals remaining in the district, in ways, which will benefit all of the many present and future stakeholders in the enterprise. The prospect of mining for the next 100 or more years, creating many hundreds of billions of dollars of wealth, in a socially responsible way, is an opportunity too good not to pursue. The groundwork in this most-famous of “brownfield” mineral districts has already been laid.

The following fundamental, realistic and practical conditions and constraints, at a minimum, will have to be satisfied or adhered to, for any major, long-term mining enterprise to succeed at Butte:

- All mining, milling and processing of ores and metals must be done in a way that is fully compliant with existing and future reasonable environmental and reclamation standards.

- “Uptown Butte” and “the Flat” must be preserved, including minimal disturbance of the existing surface by new mining facilities, and the prevention of subsidence.

- The mines will have to be run without involvement of human labor underground.

- A meaningful majority of the stakeholders in the enterprise will have to be onboard with the project, which will require an unprecedented, creative and unified approach by city, county, state and federal governments and regulators. The residents and businesses of Butte city and Silver Bow County, as individuals and entities most directly affected, will have to support the project, fully recognizing that as in any major undertaking it will be impossible to satisfy everyone. For the Butte Enterprise to succeed, the majority will have to agree to support and go forward with the venture, with the understanding that the aggrieved minority will have to stand aside for the better good of all.

- Private owners of mineral rights and interests, including Montana Resources, ARCO and its subsidiaries, and others, will have to agree to aggregate their interests in a fair and equitable way to make the entire enterprise possible.

- The venture must have the ability to proceed forward without the burden or threat of legal or administrative action to delay, hinder or prevent the project. As necessary, special legislation at both federal and state levels will need to be enacted to insure that the project can move ahead. The author recognizes that this will involve a “sea-change” in the way mining projects (in particular) are treated in the U.S.

THE BUSINESS ORGANIZATION AND COSTS

Simplistically, the contemplated business venture for mining the Butte resource—here referred to as the “Butte Enterprise”—can be viewed as a “private-public partnership,” involving governmental units and agencies and private parties (individual and companies) with property ownership interests. The governmental agencies directly and indirectly will be representing and acting on behalf of the populace at large.

One general model for the Butte Enterprise could be the Federal National Mortgage Association (Fannie Mae). As such, the Butte Enterprise would be a “government-sponsored enterprise,” which would operate as a publicly traded company. It would be a private corporation, chartered by Congress, and authorized by the state of Montana, but pursuant to its charter would have the limited business activity and purpose of developing and mining the Butte resource, and processing and selling the recovered Butte metals. It would raise development funds on its own, and will have no actual or implicit governmental guarantee on its borrowings. The parties organizing the Butte Enterprise would agree on the initial shareholdings, with significant shares to be held by Montana Resources, ARCO and other private property owners contributing mines, mineral interests, plant and equipment to the venture. The Continental Pit mine and business would become part of the Butte Enterprise. Other shares would be held by federal, state, county and city governmental entities, in recognition of the economic and societal interests of their constituents in the venture. Specific provisions would be enacted by Congress and the Montana state legislature to remove legal and practical roadblocks and allow for development, mining and processing operations to take place, subject to reasonable and appropriate environmental safeguards for future activities. The Butte Enterprise would have the power of eminent domain in furtherance of its purposes, with provision for reasonable and prompt compensation, in Butte Enterprise shares or cash, for property interests taken. Sufficient total shares would be authorized to permit purchase of stock by the public, both upon formation and subsequently, although shares held by governmental entities would be held for the benefit of their respective constituents in perpetuity. The shareholders would vote their shares for a board of directors, which would select and oversee senior management.

The author fully appreciates the difficulties facing creation of the Butte Enterprise. Interested parties will have to come together, agree on, research and plan out the venture in advance of its formation. Governmental entities at all levels will have to rise above preconceptions of how mining should be controlled and conducted, in a spirit of seldom-seen cooperation, to create this new business paradigm. Likewise, the private mineral interest owners will have to see the wisdom of subsuming their parochial interests into a grand venture, recognizing that it ultimately will be better to have a small interest in a very large economic pot, than a large interest in a much smaller pot. For many of these private owners, the Butte Enterprise will provide the opportunity to achieve some return on their mineral and other property interests, against the prospect of either no return or the continuing costs of environmental or other expenses. The existing “Superfund” onus will have to be removed, with prior environmental liabilities and obligations terminated, so that the venture can proceed without the burden of this prior legal and financial baggage.

The Butte Enterprise will have the advantages of access to cash flow from the existing Continental pit operation, and having much of the required infrastructure already in place. New mining will begin near the surface in both the selective-vein and bulk tonnage modes, so that the project early on can be put on a “pay as you go” basis. However, the project will require large, new processing facilities, including a new concentrator, a new “chemical smelter,” and a new refinery complex, as well as the necessary infrastructure to connect these plants and supply them with water, electricity and natural gas; tailings and waste processing and storage facilities; and related plants and equipment.

For the very large production tonnage contemplated here, it will be necessary to invest billions of dollars in mine development, plant, equipment, machinery, infrastructure, utilities and the like. In this regard, Butte will be no worse off, and in some respects better off, than some other current and planned large copper projects.

THE MINING PROJECT

The challenge of mining the huge remaining Butte resource would be immense, but on the other hand, the results should more than justify the effort and commitment of all involved.

This would be a project of both statewide and national significance and importance.

Future mining will involve three methods of mining: the continuation of existing open-pit mining, automated underground bulk tonnage mining, and automated selective-vein mining.

The Pittsmont Dome Upthrown Block resource will continue to be mined from the Continental pit, in the manner presently employed by Montana Resources, being the most efficient way to extract this low-grade, surface-exposed resource. Waste, leach rock and tailings will be disposed of in accordance with current mine plans, and the Butte concentrator will continue to process the Continental pit ore.

Cash flow from Continental pit operations will allow the Butte Enterprise to plan for large-scale automated underground operations, develop the necessary mining methodology, technology and equipment in concert with OEMs to conduct such operations, and help pay for mine, mill, smelter and refinery costs.

Underground operations will involve both selective-vein mining and bulk rock mining. All underground mining will be done either by remote-controlled or autonomous equipment, making full use of robotic capability and artificial intelligence. The objective will be to have no men underground.

Bulk tonnage (non-selective) mining will employ panel caving and/or other, high-volume, low per-ton cost, controlled mining method, with cemented and reinforced (as necessary) paste tailings backfill pumped into the mining voids, placed tight to the back to support the overlying and adjacent rock and provide a solid roof to subsequent mining from the next level below. The goal will be to have close to 100% ore extraction, with underground passages and mining methods designed to eliminate the need for shaft or other ore pillars. Bulk mining first will remove the Enrichment Blanket, and then as operations progress downward, the Berkeley gross pit resource, the Intermediate-depth “Kelley Blocks” resource, the Intermediate-depth zinc-copper resource, and eventually the Anaconda and Pittsmont downthrown block domes.

Selective-vein mining will be carried on simultaneously at many places within the district, in accordance with a detailed development plan for the entire vein subsurface. The selective-vein mining will begin with veins near the surface, and with the passage of time will work deeper into the district. The principal mining machine will be an “automated vein continuous miner machine’ (AVCMM),” designed specifically for Butte. Mining will be “top down” (underhand) with the AVCMMs making successively lower horizontal or gently inclined cuts in the vein. Cavities created will be backfilled by cemented paste tailings, emplaced tight to the back to support the overlying and adjacent rock and provide a solid roof for subsequent AVCMM mining below.

Viewed objectively, the whole process of selective underground mining as practiced by Anaconda and other Butte mining companies prior to mine closure was primitive and hugely labor-intensive. The “reality” facing underground metal mining in the U.S. in the 21st century is that few workers nowadays wish to work underground, with the result that labor costs are high and will only continue to rise. Today’s society is not tolerant of even a single mining fatality, and humans are fallible, and put themselves at risk of serious injury or death, beyond the inherent risks associated with working underground.

In the near future, continuous, remote-controlled/autonomous mining will be able to completely replace the old-fashioned human-conducted drill-charge-blast-muck mining cycle, without risk to human health and safety, and with increased efficiency and productivity. Butte is an ideal venue for further development of this new mining technology, tailored specifically to the needs and demands of the district, given the huge size of the Butte resource.

CONCENTRATING, SMELTING AND REFINING

Milling will continue at the Butte concentrator until the Pittsmont Dome Upthrown Block resource is exhausted. The Butte concentrator then will be dismantled, and the land surface restored to non-mining use. The Enrichment Blanket deposit extends under the Butte concentrator, but will be mined in such a way, using cemented paste tailings backfill, that will prevent surface subsidence. Underground mining will require new milling plants and infrastructure, including a large new concentrator, to be located in the extensive area of gently rolling topography north of Butte.

The Butte Enterprise will include processing of the mill concentrates to produce purified copper, zinc, lead, silver, and gold, as well as high-grade molybdenum oxide, and byproduct metals and metalloids. The complex of plants comprising the hydrometallurgical chemical smelter, and refinery will be sited on one of several possible areas north and west of Butte.

Necessary water will be pumped from the underground mines, and if necessary obtained from the water sources used by The Anaconda Co. when it operated its concentrator and smelter complex at Anaconda city.

The “chemical smelter” complex will employ state-of-the-art hydrometallurical methods to produce metals for the refinery, with minimal discharge of pollutants to the atmosphere, surface or ground water. Solid wastes will be disposed of in a suitable impoundment area.

The refinery complex can draw upon the many years of successful refinery operation by Anaconda in Great Falls, Montana, USA. As with the “chemical smelter,” the new refinery will be a state-of-the-art plant, taking advantage of technological improvements since Anaconda’s refinery closed. Railroads and interstate highways are present in the district, thus further minimizing both plant construction cost and shipment cost of refined products to markets.

1 The author, mining consultant, geologist and attorney, has had a long interest in the Butte district, having been employed as a geologist by The Anaconda Co. between 1966 and 1969 in various capacities while working on a Ph.D. thesis on the structure and mineral zoning at Butte. He presently is writing two Butte books, covering mining. The author has no employment or other economic interest in the Butte district. The ideas in this article are offered simply for the purpose of stimulating interest in, and investigation of, the possibilities for future mining of the resources of the Butte district. He can be reached at: bwray@scinternet.net.

2 As of July 1: copper at $3.18/lb, zinc at $1.00/lb, lead at $0.97/lb, molybdenum as MoO3 at $13.61/lb, manganese 44% Mn concentrate at $416/mt of contained Mn, silver at $21.24/troy oz and gold at $1,327/troy oz.