Metso announced on May 3 it has entered into a five-year, long-term strategic services partnership agreement with Tata Chemicals (Soda Ash) Partners to repair, rebuild, and service existing pyro-processing equipment and systems in its Green River, Wyoming, USA, operation. The total contract value is approximately €27 million.

Metso will rebuild seven calciners and 12 rotary dryers at Tata Chemicals’ soda ash processing plant in Wyoming, USA, over a five-year period.

The contract covers the rebuilding of 19 existing pyro-processing units over the contract period, which includes the supply of installation labor, training for site personnel, and full-time Metso personnel on-site to oversee the execution of the work. The scope of the new agreement for the seven calciners and 12 rotary dryers also includes several modernization and upgrade measures to improve safety, efficiency and operational flexibility at the Green River facility. A part of the agreement is booked in Metso’s second quarter 2016 orders received, leaving the rest to be booked throughout the agreement period.

Metso said the deal is in concert with its long-term strategy to expand service operations in the western U.S. mining and industrial market, including Wyoming, Utah, and northern Nevada, where a significant and broad installed base exists.

Tata Chemicals (Soda Ash) Partners is a leading producer of high-quality soda ash. Headquartered in New Jersey, TCNA’s manufacturing operations are based in Green River. The operation was the subject of a feature article in our June issue (See Progress in the Patch, pp. 54–60, June 2016).

One day after the soda ash announcement, Metso also reported that Sedibeng Iron Ore (Pty) Ltd., located in the Northern Cape, South Africa, had ordered a stationary crushing and screening solution from the company.

The value of the order was not disclosed. It includes a stationary crushing and screening plant, including primary and secondary crushers. Cold commissioning is scheduled for late 2016, and the plant should be operating at the beginning of 2017, according to Metso.

“For Metso, the order represents a new way of operating in southern Africa. It increases our installed base in the area and will surely open up new opportunities in the growing market,” said Charles Ntsele, Metso’s general manager for mining sales in southern Africa.

The Sedibeng Iron Ore operation, 64% owned by Tata Steel, has been using a Metso mobile crushing and screening solution operated by a subcontractor. Due to a planned increase in capacity, Tata Steel wanted to investigate the benefits of a stationary plant.

“The key target for Sedibeng was to both guarantee plant availability and lower their production costs. We worked with the customer in analyzing their needs, such as operating costs and plant availability. For example, the design of the plant was carefully considered and the process design criteria reviewed. Based on the analysis, we came up with a technical solution that will increase plant availability from 65%–70% to 90% and increase plant capacity to 600 metric tons per hour (mt/h),” Ntsele explained.

The complete package consists of a 561-2V vibrating feeder, C130 jaw crusher, CVB 603 screen, HP 500 cone crusher, conveyors, electrics and automation along with other auxiliary equipment. A life cycle services contract with Metso covers supervision of plant maintenance including planning and worker training as well as spares and wear-parts management.

Sandvik Outlines Strategy, Forms JV to Build Midmarket Equipment

Mining equipment supplier Sandvik outlined its financial and business strategy targets for the coming years at its annual Capital Markets Day for investors, held May 24. Sandvik’s president, Björn Rosengren, said, “We will run our businesses with focus on stability, profitability and growth—with our different businesses currently at different stages. Through increased decentralization of our business model, decisions are made closer to the customers and we will improve the speed in responding to our customers’ requirements and to changed market activity.

“Within the business areas, each product area will have total ownership and accountability of the respective operations, which will generate improved transparency,” he added.

“This creates an entrepreneurial environment, developing strong leaders. There will be no quantum leaps, but I expect each business to achieve constant improvements.”

Lars Engström, president of Sandvik’s mining business, described his group’s strategy and near-term focus goals. These include:

- Implementing a decentralized business model with eight product areas based on the product offering.

- Growing the aftermarket business by the global roll-out of customer service centers and new or improved customer offerings such as new e-solutions, and increased productivity through data-driven predictive maintenance.

- Improving profitability through product launches and technologies supporting value-based pricing, growing the after-market business, ongoing supply chain optimization program and focusing on cost efficiency.

In setting new financial targets through 2018—with 2015 as the starting point—Björn Rosengren said, “Previous targets were based on a different macro environment than what we currently have. In my view, our new targets are appropriate and ambitious for Sandvik in times of change as well as in expectations of a continued muted macro environment, yet signaling my strong belief that the new decentralized business model will result in a more cost efficient organization with higher pace. Targets can be achieved both through support from top-line growth as well as internal performance improvement.”

The targets include:

- ≥7% EBIT growth (Compound Annual Growth Rate).

- ≥3% improvement of return on capital employed (ROCE).

- Net debt/Equity ratio of <0.8.

- 50% dividend payout ratio, of reported earnings per share.

During the week following the Capital Markets event, Sandvik and Lingong Group Jinan Heavy Machinery of Jinan, Shandong Province, China, announced they have agreed to form a venture for the production and sales of surface and underground mining equipment, targeting midmarket customers. Sandvik will own the majority share of the venture.

The joint venture is scheduled to become operational in the second half of 2016 and will be a part of Sandvik’s Mining and Rock Technology business. It will focus on sourcing, assembly, sales and service of surface drills, underground loaders, and underground trucks. The products will be designed for the specific needs of midmarket customers and will be sold under an independent brand. While the initial focus will be to supply the products for the Chinese market, the goal of the joint venture is to become the leading midmarket mining equipment supplier for other selected parts of the world.

“This joint venture agreement is in line with Sandvik’s strategy to develop a strong foothold in the fast expanding midmarket for mining equipment,” said Engström.

Kal Tire Opens Service Center in Eastern Australia

Kal Tire’s Mining Tire Group has expanded its presence in the Australian mining sector with the opening of a new mining tire repair facility near Muswellbrook, New South Wales—the first of several moves the company expects to make as it expands its mining tire management service offerings in eastern Australia.

“Kal Tire has been supporting the Western Australian mining industry for many years, and we were keen to bring more of our services to customers on the East Coast,” said Darren Flint, managing director of Kal Tire Australia, noting plans are under way to continue expanding in the region.

Located within the Hunter Valley coalfields, the Kal Tire facility will continue to repair mining tires that were serviced there when it was formerly operated by Goodyear. Technicians can have up to eight tire stands in operation at any time, with the capacity to handle an extensive volume of mining tires and the capability to repair all mining tire sizes up to 63 in.

The company said its exclusive Ultra Repair technology for ultra-class tires will be introduced into this facility later this. The Ultra Repair process involves replacing steel belts inside ultra-class tires, offering what it claims is an unrivaled ability to restore the original strength, integrity and performance of damaged ultra-class tires at a fraction of the cost of new tires.

Kal Tire’s Mining Tire Group employs 1,600 people and operates at more than 150 mine sites around the world.

Kal Tire’s new facility, located in Australia’s Hunter Valley coal district, has the capacity to repair all mining tire sizes up to 63-in. diameter.

Wenco to Release New Readyline Version

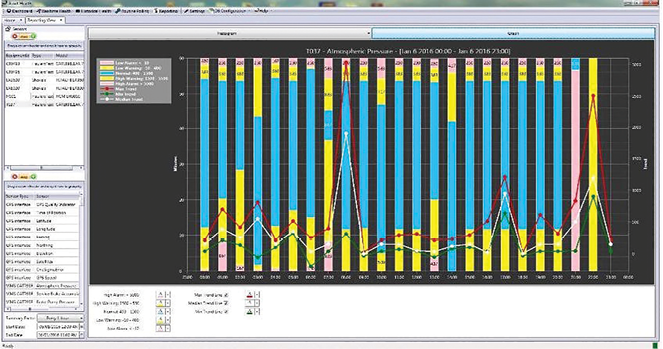

Wenco, which offers fleet management, dispatching, machine guidance and maintenance solutions for surface mining operations, is getting ready to introduce the latest version of its Readyline product in July. This version, according to the company, offers two innovations that give mines unprecedented flexibility in equipment condition monitoring.

Readyline version 1.4 incorporates virtual signals and alarms to comple-

ment the OEM data already in the system. With a few clicks, mines can select multiple sensors and define their thresholds to track a set of conditions, even if the OEM system lacks a native signal for them. For example, a mine can track the cooling efficiency of its engines by entering the following formula in the virtual signal window:

Cooling Efficiency f(x) = (Engine RPM >58.2 * (TemperatureEngine – TemperatureCoolant) / (TemperatureEngine – TemperatureAmbient))

Then, maintenance can set Readyline to poll and watch the cooling data stream into the dashboard.

Along with virtual signals, the latest release also introduces a new database structure. Wenco said its new time series database with scalable server architecture moves the system away from the siloed SQL database and toward a true Big Data solution. With enhanced storage and access, maintenance crews can instantly sift through years of historical sensor data to pinpoint needed information.

“This is a solution that can really change how a mine performs,” said Hiro Hirowatari, Wenco’s director of technology. “Readyline has advanced a lot in a short time and the outcomes are substantial. Now, with virtual signals and a better database, mines can monitor machine components any way they want. It ought to have a major effect on equipment uptime and preventive maintenance.”

Along with other new features, the latest release of Wenco’s Readyline introduces a new database structure that uses scalable server architecture to advance the system toward a true Big Data solution.

AngloGold Ashanti Extends Global Comms Network Contract

Orange Business Services has announced the extension and expansion of its network contract with AngloGold Ashanti. The deal delivers a range of network services across 44 sites in Africa, America and Australia to improve collaboration and securely manage internet and cloud growth.

Headquartered in Johannesburg, South Africa, AngloGold Ashanti has 21 operations on three continents and currently has several exploration programs under way in both established and new gold-producing regions of the world. The multimillion dollar, multiyear contract builds on the 12-year relationship between Orange and AngloGold Ashanti.

The hybrid network includes terrestrial and satellite connectivity, managed security and Business VPN Internet. According to Orange Business Services, the network will allow AngloGold Ashanti to securely manage growing internet traffic and create a better end-user experience for employees at all sites. The solution also enables worldwide application of security policies and delivers the flexibility necessary for enabling the use of cloud-based business applications.

The network, said Orange, is optimized for unified communications and enables AngloGold Ashanti’s employees to use corporate applications, including voice, video and instant messaging communications securely across its entire global operation. A managed Infrastructure-as-a-Service (IaaS) solution from Orange called Flexible Computing Premium will allow employees to access cloud-based applications such as mission-critical global ERP based on SAP with greater ease.

Orange said that, beyond the initial scope of connectivity, employee communications, cloud computing and security, the agreement opens the door for co-innovation, for example, in the areas of e-health, underground safety, material, tools and maintenance cost management, and environmental monitoring.

MAPEI Enters North American Market

MAPEI, a privately owned specialty chemicals producer based in Italy, said it has entered the underground technology arena in North America with a team of specialists who are working with contractors, engineers and owners’ representatives for tunneling, hard-rock mining and other large underground projects. According to the company, this integrated approach—drawing from the expertise of MAPEI engineers, research and development (R&D) personnel, and on-site representatives—is an extension of a global program that the company initiated in Europe. The technology has already been successfully transferred to Asia, Africa and Latin America.

“We feel that MAPEI has a solid core group of products to meet the needs of this market segment, and the depth and breadth of knowledge of our R&D people will help us find solutions for the challenges that engineers encounter in this field,” said Wesley Morrison, country manager for the company’s Americas Underground Technology Team (UTT).

MAPEI’s product solutions encompass:

- Admixtures, alkali-free accelerators and hydration control for the improvement of sprayed concrete.

- Soil-conditioning systems, sealants, abrasion control and annulus grouting systems for mechanized tunneling.

- Injection products such as microcements, polyurethane technology, acrylic resins, mineral grouts and anchors.

- Sprayable membranes, PVC sheet membranes and ancillary products for water-proofing.

- A sprayable mortar-based system for fire protection plus epoxy final coatings.

- Gunite and repair mortars for rehabilitation.

“As we develop our portfolio of North American projects, we hope to increase MAPEI brand awareness and establish ourselves as a ‘go-to resource’ in the underground construction category,” said Luigi Di Geso, president and CEO of MAPEI Americas.

Among MAPEI’s products for tunneling and other underground construction applications are waterproofing products such as the PVC and sprayable membranes shown here.

Terratec Borer Scores a Double in China

Terratec recently reported that one of its TR3000 raise boring machines has successfully completed two ventilation shafts at copper operations in China’s Sichuan Province. Terratec, based in Australia, is a designer and manufacturer of tunnel and raise boring machines and other custom-made products for tunneling and mining applications.

Both of the shafts—sunk in rock considered to be of medium compressive strength (100 MPa)—are 3.1 m (10 ft) in diameter. According to the company, reaming of the first shaft was completed in 28 days and the second in just 16 days.

Terratec said the raise borer will be relocated to another site in China’s northern region to bore 300-m-deep inclined shafts that will be 2.4 m in diameter.