|

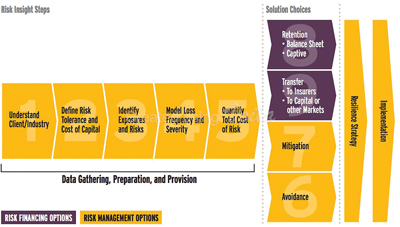

| Willis Group, a global risk adviser and insurance broker, recommends that in the face of tighter financial conditions, mining companies should focus on ways to maximize their current insurance programs rather than cutting back on coverage. This chart offers a roadmap to achieve optimal benefit. |

With the prospect of rising costs, falling commodity prices and decreased productivity levels, mining companies are embracing cost-cutting measures to lay the foundation for long-term business growth, according to Mining Risk Review 2014, a publication from Willis Group Holdings, a global risk adviser, insurance and reinsurance broker.

“To date, the bulk of cost cutting has come via reduction of head office spend, exploration and business development. We have not yet seen loss-making production assets curtailed or substantial cost cutting at the asset level,” according to the report, which is available online.

But Willis warned companies not to be tempted to cut back on risk management outlays in order to achieve cost reductions. This could be fundamentally self-defeating as the costs saved are marginal but leave potentially enormous exposures, cautioned Willis.

Instead, mining companies should look for ways to extract maximum value from their insurance programs, said Andrew Wheeler, senior advocate partner in Willis’ Mining Practice. “Often, mining operations have highly developed risk registers and risk management systems but on checking in the field there is disconnect between what is planned and what is really happening,” he said. “There is often a poor understanding of risk controls in the workplace, poor implementation, and a lack of robust reviews and audit systems to ensure the controls are working.”

“Successful companies manage their business processes to reduce loss,” Wheeler added. “Good levels of control and business continuity planning can help ensure that large loss events are reduced as far as possible. It is this level of commitment to strong risk management processes that define resilient mining operations.”

“Strong and consistent leadership is also critical to the success of any operation. Management sends a strong message when senior people take time out to visit the field operations, engage with people on the job, and challenge people to do better.”

“Lower reinsurance costs, increased competition and a relatively benign loss environment, have combined to the advantage of insurance buyers in 2014,” he added. “In all, companies who can drive down costs and protect their margins in this tough climate are the ones who will be resilient to the threats they face.”

The report went into deeper detail on what the Willis Group perceives as major risk-assessment concerns for the industry, commenting that:

- While capital dilemmas may have risen to the top of the risk table for the coming year, mining companies must not forget the more “traditional” risks that will threaten their operations. Resource nationalism continues apace, made worse by the yawning gap between public perception and commercial realities. Generally, local populations are unaware of the falling commodity prices and believe mining companies are continuing to make huge profits. In a tough economic climate, governments are under increased pressure and mining companies can become convenient scape/goats in the run-up to elections.

- Conversely, skills shortages, which have been such an issue for the last few years have abated, simply because the number of active operations has reduced. However, that is not the end of the risk. Companies are still facing a challenge in attracting the right people with the right skills. They also have to battle bureaucracy and ensure they observe local quotas. Cost cutting may be a feature of the business but cutting back on training could prove to be a short-term fix with long-term implications as human error continues to lie behind the majority of accidents and incidents at sites and beyond.

- Finally, once the minerals have been extracted, mining companies also face challenges in delivering the product to customers in the right place at the right time. The phenomenon of just in time delivery continues to drive logistics worldwide and remains a risk. In all, companies who can drive down costs and protect their margins in this tough climate are those who will be resilient to the threats they face.