By Steve Fiscor, Editor-in-Chief

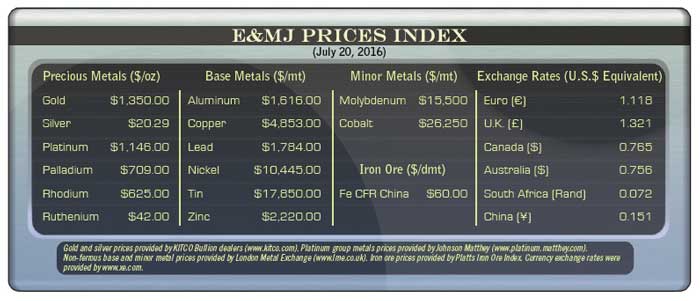

Prices for several metals made notable moves during July. Gold finished the month near its high for the year at $1,350/oz, up $28.30/oz or 2.1%. On July 6, it reached a two-year high of $1,366.25/oz. Similarly, silver finished at $20.29/oz, and a $1.59/oz increase during July

or 8.5%.

The first half of 2016 has seen a dramatic change in the rhythm and flows of the gold industry, according to GFMS Thomson Reuters. In the GFMS Gold Survey Q2, it noted that even before the British vote to exit the European Union, physical demand was down more than 20% year-on-year, with Asian offtake being exceptionally weak. Demand for gold from exchange traded funds (ETFs), however, have set a new record half-year total with 586 metric tons (mt) purchased in 2016. During 2015, ETFs liquidated 125 mt of gold holdings.

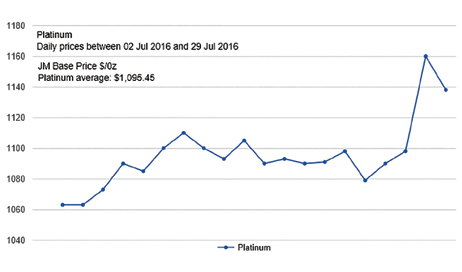

While gold and silver made notable moves, the big story during July was platinum and palladium. Platinum climbed to $1,146/oz from $1,006/oz, or $140/oz, a 13.9% increase. Doing even better on a percentage basis, Palladium climbed to $709/oz from $593, or $116/oz or 19.6%.

Toward the end of July, the Association of Mineworkers and Construction Union (AMCU) began wage negotiations with South African platinum mining companies. AMCU was seeking a wage increase to R12,500/month ($875/month) for its lowest paid workers. As of press time, no deal had been struck and platinum and palladium prices were moving higher.

Iron ore also managed to climb to $60 per dry mt (dmt) from $54.65/dmt last month, an increase of 9.8%. Sentiment in China’s steel market rebounded strongly in July, with most market participants expecting steel prices to rise over the next month, according to the latest S&P Global Platts China Steel Sentiment Index (CSSI) for July, which showed a headline reading of 53.71 out of a possible 100 points. The July index jumped 37.79 points from 15.92 in June, reaching a three-month high and again breaching the 50-point threshold. A reading above 50 indicates expectations of an increase/expansion and a reading below 50 indicates a decrease/contraction.

Gold and silver prices provided by KITCO Bullion dealers (www.kitco.com). Platinum group metals prices provided by Johnson Matthey (www.platinum.matthey.com).