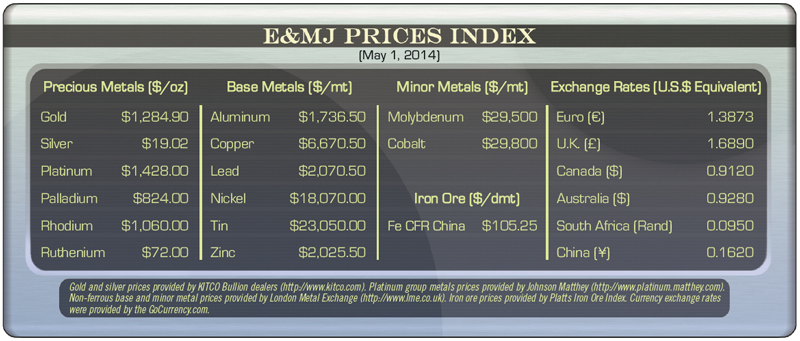

Month-to-month, there was little change in the E&MJ Price Index except for one metal: nickel. During April, nickel prices jumped $2,300 per metric ton (mt) to $18,070/mt from $15,770/mt, an increase of 14.6%. That follows a 10.4% month-to-month increase in March from $14,285/mt. In two months, nickel has climbed to $8.21/lb from $6.49/lb. So where does it go from here?

Month-to-month, there was little change in the E&MJ Price Index except for one metal: nickel. During April, nickel prices jumped $2,300 per metric ton (mt) to $18,070/mt from $15,770/mt, an increase of 14.6%. That follows a 10.4% month-to-month increase in March from $14,285/mt. In two months, nickel has climbed to $8.21/lb from $6.49/lb. So where does it go from here?

The answer to that question varies with geopolitical persuasions. Much of the price increase can be attributed to the Indonesian ore export ban. The civil unrest in Ukraine and possible economic sanctions on Russia are also having an impact. Nickel miners in Indonesia may be frustrated unless they work for Vale, nickel miners in Russia may be worried, and nickel miners in Sudbury should be grinning once they thaw.

Vladimir Potanin, CEO Norilsk Nickel, which is located in the Kola Peninsula of eastern Russian, told Bloomberg reporters concerns that supplies of the metal will be disrupted by sanctions against the country over the crisis in Ukraine are overstated. The prevailing belief is that Norilsk, the largest nickel producer, would see sales diminished by sanctions, but Potanin said the medium-term outlook is for stable prices as Indonesia starts its own processed nickel production within the next two years. Anti-Russian sanctions aren’t affecting Norilsk’s business so far, he said. Saying it had done nothing to support a peace accord, the U.S. has imposed sanctions on seven Russian officials and 17 companies. Russia said the Ukrainian government has failed to meet its obligations.

Vale is the second largest nickel producer with mines in Brazil, Canada,

Indonesia and New Caledonia, and refineries in China, South Korea, Japan, the U.K. and Taiwan. Vale Indonesia processes all of its nickel ore in the country at four smelters and received an export permit from the government in February.

Vale’s quarterly nickel production increased 67,500 mt from 65,100 year-on-year, which was a new record for a first quarter. The negative impacts from a longer and colder winter at its Canadian operations were offset by increased production from Onça Puma and Vale New Caledonia, CEO Murilo Ferreira explained.

While these are the highest levels the market has seen in 15 months, nickel prices traded around $25,000/mt in 2006, and reached a high of $54,000/mt in 2007 prior to the global financial crisis.