By Steve Fiscor, Editor-in-Chief

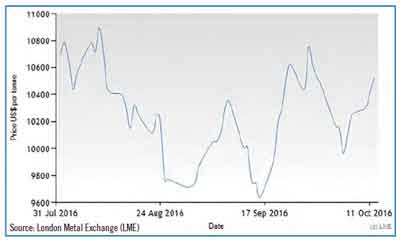

The news that 30 mines, 18 of them nickel producers, in the Philippines would be closed caused nickel prices to spike briefly during September. Nickel prices on the London Metal Exchange (LME) had dropped from more than $10,800 per metric ton (mt) in early August to a little more than $9,600 by mid-September. Prices then grew almost to $10,800/mt at the time the news broke of the possible closure in the Philippines and the market has been searching for direction since.

Global demand for nickel is expected to be 1.9 million mt in 2016. Collectively, the mines in the Philippines export 35 million mt per year (mt/y) of nickel ore, which amounts to 277,000 mt of nickel. Russia and Canada account for about 240,000 mt, while New Caledonia produces about 190,000 mt/y. Indonesia led the world at one time, but its production has declined to 170,000 mt/y since the country adopted its ore export ban.

“Nickel’s recent 15% price increase is attributed to Philippines nickel ore mines being bashed and closed by its new president and environmental czar,” said John A. Hunsaker, president, Innovative Metals, Inc. “The price spike was single handedly caused by their impetuous actions and nothing to do with market fundamentals.”

In a LinkedIn blog post, titled “There is No Nickel Shortage!” Hunsaker put the market into perspective. Current nickel stocks on the LME total 371,000 mt; Shanghai Futures Exchange stand at 105,000 mt; and there could be as much as 500,000 mt of off-exchange stocks; together equaling six months of estimated global consumption.

Indonesia has vast reserves of nickel. Before Indonesia banned ore exports in 2014, almost no one knew or cared about Philippine nickel ore. Indonesia and China, Hunsaker explained, have an excellent financial relationship and are cooperating, unlike the Philippines and China. “China is offshoring its nickel pig iron [NPI] requirements with huge investments in Indonesia to become self-sufficient for its stainless steel requirements,” Hunsaker said. “Chinese production of NPI in Indonesia is happening at the speed of money and is voluminous.”

The future of nickel lies in laterite ore as opposed to the traditional sulfide ores, according to Hunsaker. Methods for making meltable nickel products from laterite nickel ore are a work in progress and a preponderance of laterite nickel ore is located in Australia, New Caledonia and Indonesia.

Innovative Metals plans to launch www.nickel28.biz as a subscription website providing information about nickel during November.