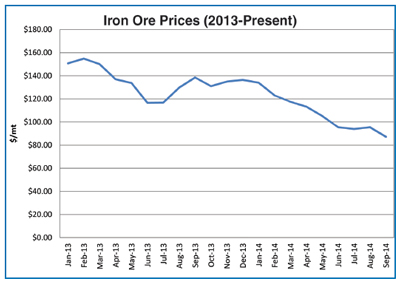

Seaborne iron ore prices hit a five-year low on August 27, with the Platts 62% Fe Iron Ore Index (IODEX) falling $0.75 day-over-day to $88 per dry metric ton (dmt) Cost and Freight (CFR) North China. The last time the 62% Fe IODEX was lower was July 21, 2009, when it was assessed at $87.50/dmt CFR North China, according to Platts Metals.

Seaborne iron ore prices hit a five-year low on August 27, with the Platts 62% Fe Iron Ore Index (IODEX) falling $0.75 day-over-day to $88 per dry metric ton (dmt) Cost and Freight (CFR) North China. The last time the 62% Fe IODEX was lower was July 21, 2009, when it was assessed at $87.50/dmt CFR North China, according to Platts Metals.

The Steel Index (TSI) 62% Fe iron ore price fell $0.70 day-over-day to $88.2/dmt CFR Tianjin, bringing it to its lowest point since September 6, 2012. The fall in iron ore prices was due to bearish steel fundamentals and a general lack of market confidence in China.

“Prices have fallen due to an overhang of material, particularly from Australia; and with falling steel prices, steel mills are hesitant to buy,” said Annalisa Jeffries, associate editorial director of Platts metals. “Additionally, prices of iron ore that are stocked in port are below prices of imported cargoes. Financing cargoes has also become more difficult as larger deposits are now required by banks to issue letters of credit.”

At the same time, oversupply of iron ore has put pressure on spot prices. “The iron ore market has moved into oversupply at a time China’s economy is slowing, putting downward pressure on iron ore spot prices,” said Oscar Tarneberg, TSI senior analyst. “The summer period has seen the usual seasonal slowdown in demand exacerbated by fresh concerns about the health of China’s property sector, and a weakening in previously resilient steel export prices.”

With end-user buying continuing to ebb as Chinese mills steered clear of spot commitment, spooked by bearish steel fundamentals and a general lack of market confidence, bids pulled back from existing offer levels, resulting in significantly lower trades. Sources said further falls were to be expected in the longer term because the market has clearly flipped to a buyer’s market.

According to Platts, a Hebei-based steelmaker said, “We’ve all gotten used to having very low iron ore stocks and only buying if and when we have a specific steelmaking need to fill. There is no such thing as buying extra material to stock up.” The steelmaker also added that another factor was the common knowledge that there was a lot of available material around, both in the seaborne and port stock markets.