At the Annual Silver Industry Dinner hosted by the Silver Institute in mid-November, Johann Wiebe, senior analyst in the GFMS team at Thomson Reuters, presented the GFMS/Silver Institute Interim Silver Market Review, which included provisional supply and demand forecasts for 2016.

The silver market was expected to be in an annual physical deficit of 52.2 million oz in 2016, Wiebe explained, marking the fourth consecutive year in which the market had realized an annual physical shortfall. “While such deficits do not necessarily influence prices in the near term, multiple years of annual deficits can begin to apply upward pressure to prices in subsequent periods,” Wiebe said. In 2016, an expected 71.4-million-ounce (oz) net inflow into ETF holdings and a 61.9-million-oz derivatives exchange inventory build on a year-to-date basis (end-October) have increased the impact of the physical deficit, bringing the net balance to -185.5 million oz, equivalent to approximately nine weeks of global demand. Above ground stocks, including ETF’s and exchange inventories, were estimated to reach 2.64 billion oz in 2016, a 15% increase from the previous year.

The silver market was expected to be in an annual physical deficit of 52.2 million oz in 2016, Wiebe explained, marking the fourth consecutive year in which the market had realized an annual physical shortfall. “While such deficits do not necessarily influence prices in the near term, multiple years of annual deficits can begin to apply upward pressure to prices in subsequent periods,” Wiebe said. In 2016, an expected 71.4-million-ounce (oz) net inflow into ETF holdings and a 61.9-million-oz derivatives exchange inventory build on a year-to-date basis (end-October) have increased the impact of the physical deficit, bringing the net balance to -185.5 million oz, equivalent to approximately nine weeks of global demand. Above ground stocks, including ETF’s and exchange inventories, were estimated to reach 2.64 billion oz in 2016, a 15% increase from the previous year.

In mid-November, the GFMS team at Thomson Reuters predicted silver prices to average $17.15/oz for the full calendar year, a 9.4% increase over the 2015 average. During December, however, prices dropped more than $1/oz from a little more than $17/oz to a little less than $16/oz.

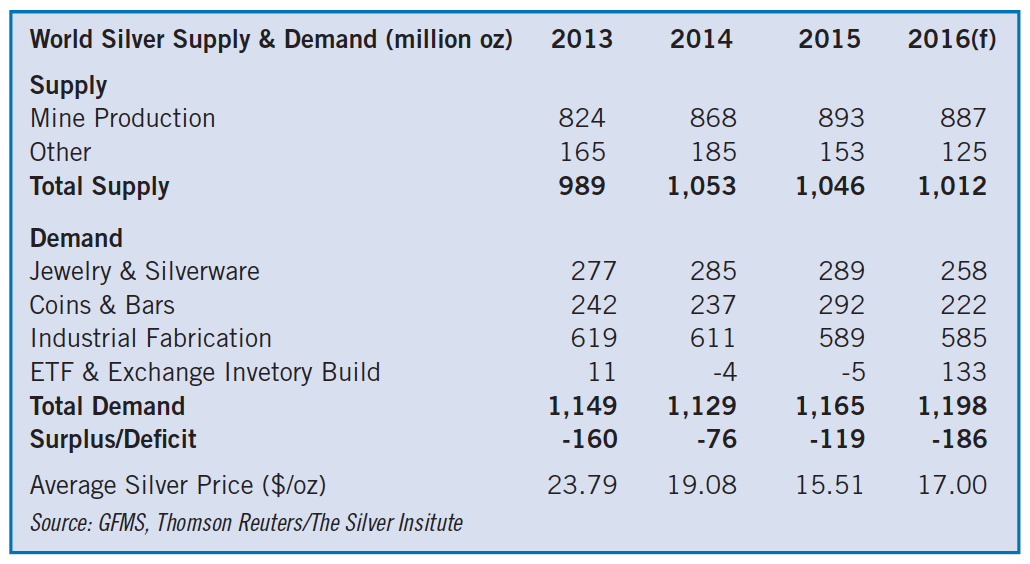

Total silver supply was forecast to fall 3% to 1.012 billion oz in 2016. The decline was expected to be driven by a 1% drop in mine production, a 0.3% fall in scrap supply and net de-hedging of 20 million oz. Mine production was forecast to reach 887.4 million oz, which was almost 6 million oz lower than 2015 and the second highest year of production on record. Healthy increases in primary silver mine production, particularly in Peru, were being partially offset by losses in silver output from lead/zinc and gold mines.

Silver bullion coin and bar sales were expected to contract 24% to 222 million oz in 2016. Bullion silver coins were forecast to reach 122.7 million oz in 2016, which was 7.9% below 2015’s record of 133.2 million oz. “The drop is unsurprising given the strong increase recorded in the prior year, when investors entered the market en masse to bargain hunt following the silver price decline during the second half of 2015,” Wiebe said. Physical bar demand was expected to contract by 38% in 2016 to 99.3 million oz.

Silver demand from the photovoltaics industry was forecast to increase by 11% to reach a record high of 83.3 million oz in 2016. The rise was driven by global solar installations, which should have reached 70 GW in 2016. China accounts for 70% of those additions in solar installations. Solar made up 14% of total industrial demand, which was up significantly from 1% a decade ago.

Jewelry fabrication is forecast to drop 8% to 208.5 million oz in 2016.