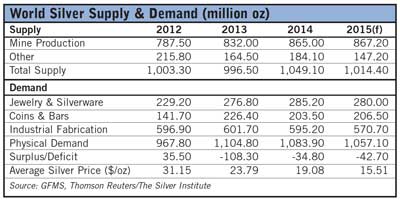

Silver is prized primarily for its dual role as a monetary asset as well as an important industrial metal used in a widerange of applications. Industrial demand for silver, the largest component of total silver offtake, is set to increase its share of total demand in 2016, according to the Silver Institute. In 2015, industrial fabrication demand accounted for an estimated 54% of total physical silver demand.

Silver’s use in photovoltaics for solar energy is projected to rise in 2016 and surpass the previous peak of 75.8 million oz set in 2011, as global solar panel installations are expected to grow at a high single-digit pace. Moreover, silver’s use in this application may account for more than 13% of total silver industrial demand in 2016, up from 1.4% a decade ago.

Silver’s use in photovoltaics for solar energy is projected to rise in 2016 and surpass the previous peak of 75.8 million oz set in 2011, as global solar panel installations are expected to grow at a high single-digit pace. Moreover, silver’s use in this application may account for more than 13% of total silver industrial demand in 2016, up from 1.4% a decade ago.

Silver demand from ethylene oxide (EO) producers is expected to jump to more than 10 million oz this year, a more than 25% increase over 2015. EO is critical in the production of plastics, solvents and detergents. This growth comes off a very robust 2015, when demand grew by more than 40%. The bulk of demand is expected to continue to come from new EO plants and expansions at existing ones located in China. China is expected to account for an estimated 80% of silver requirements for new EO capacity in 2016.

Jewelry fabrication is expected to increase by 5% in 2016, in contrast to a modest contraction last year. While the market will likely see a decline in Chinese silver jewelry demand, which accounted for around 16% of the 2015 total for silver jewelry fabrication, growth in other countries should more than offset China’s slip in demand.

Coin demand is expected to be robust once again in 2016, following a record 130 million oz of demand last year. Demand will remain elevated this year as investors take advantage of relatively lower metal prices. In 2015, coin demand made up an estimated 12% of total physical demand.

Silver exchange-traded funds (ETF) holdings fell by 2.8% by the end of 2015 compared to year-end 2014. Notably, the decline in silver ETF holdings was smaller against gold’s 8% contraction. Silver ETF holdings should continue to remain in stickier hands than those of gold’s investors, partly a reflection that silver ETF holdings have a larger proportion of retail investors.

Indian silver demand in 2016 is expected to grow on the back of increased investor interest and growth in jewelry, decorative items and silverware fabrication. India, long a mainstay of global silver demand, imported a record high 228 million oz of silver bullion in 2015. Imports rose largely due to a decrease in scrap flows.

Global mine supply production is projected to fall in 2016 by as much as 5% year-on-year. This would represent the first reduction to global silver mine production since 2002. The lower price environment provided little incentive for producers to invest in expanding capacity at existing operations. Looking further ahead, many analysts expect global silver mine production to fall through 2019 as primary silver production from more mature operations begins to drop.