The International Copper Study Group (ICSG) convened in Lisbon, Portugal during late October. Government delegates and industry advisors from most of the world’s leading copper producing and using countries met to discuss key issues affecting the global copper market. The ICSG Statistical Committee reviewed the world balance of refined copper production and use.

In developing its global market balance, the ICSG uses an apparent demand calculation for China, the leading global consumer of copper, accounting for about 45% of world demand. Apparent copper demand for China is based only on reported data and does not consider changes in unreported stocks [State Reserve Bureau (SRB), producer, consumer and merchant/trader], which can be significant during periods of stocking or de-stocking and which can markedly alter global supply-demand balances.

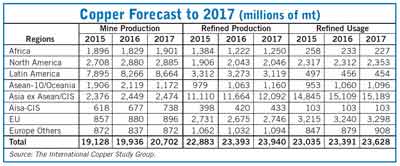

ICSG projections for 2016 indicate that the market should remain essentially balanced, while in 2017 ICSG forecasts a surplus of around 160,000 metric tons (mt). This compares with a deficit of 55,000 mt and a surplus of 20,000 mt for 2016 and 2017, respectively, forecast at the group’s March 2016 meeting. Upward revisions have been made for both production and usage in view of better than expected actual growth so far this year.

World mine production after adjusting for historical disruption factors is expected to increase by around 4% in 2016 to reach 19.9 million mt benefitting from new and expanded capacity brought on stream in the last two years. While concentrate production is expected to grow by 6%, growth will be partially offset by a 3% decline in SX-EW production due to price related production cuts in the Democratic Republic of Congo (DRC) and closures in Chile. In 2017 world mine production is expected to remain practically unchanged. Although output from current operating mines is expected to improve, growth will be offset by a 6% decline in SX-EW production and a lack of new major mine projects. Peru and Mexico are the main contributors to growth this year with Chile expected to contribute significantly to growth in 2017.

World refined copper production in 2016 is expected to increase by around 2% year-on-year to 23.4 million mt. Although electrolytic production is expected to increase by 3%, growth will be partially offset by an anticipated decline of 3% in SX-EW output. For 2017, world refined production is expected to maintain a similar growth of around 2% with the anticipated decline in SX-EW output still limiting overall growth. In both years China will be the biggest contributor to world growth while total output in Chile is constrained by an expected decline in SX-EW production.

ICSG expects world apparent refined usage in 2016 to increase by 1.5%. This is mainly because apparent demand in China is expected to increase by around 1.5%, although underlying “real” demand growth in China is estimated by others at around 4%. Usage in the rest of the world in 2016 is also expected to increase by 1.5%. For 2017, the growth in world apparent refined usage is expected at around 1%.

The next Meetings of the Study Group will be held in Lisbon, Portugal on the Thursday April 27, 2017.